Summary

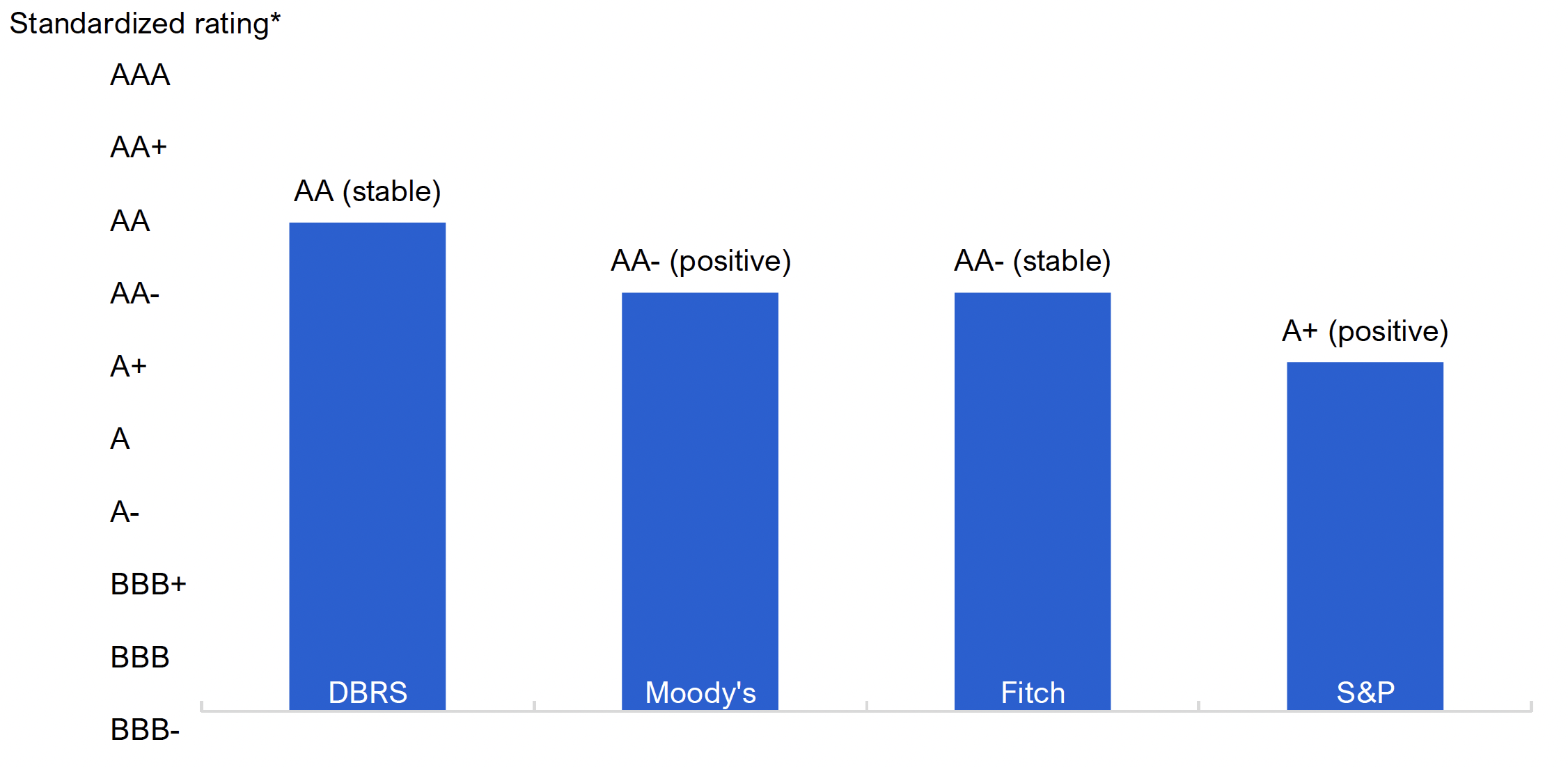

- The Government of Ontario’s (the Province’s) debt is rated by four principal international credit rating agencies, based on their assessments of Ontario’s economic and financial outlook, and future risks. These credit ratings represent the credit rating agencies’ opinions on the Province’s ability to meet its debt-related financial obligations.[1]

- In June 2024, the Province’s credit rating was upgraded by DBRS from AA- to AA.[2] Fitch, Moody’s and S&P each reaffirmed their credit ratings for the Province in updated assessments. In general, the credit rating agencies continue to rate the Province as an extremely strong, investment-grade borrower.

- S&P and Moody’s both maintained their positive outlooks for Ontario, which suggest that a credit rating upgrade for the Province within the next two years is likely. Both credit rating agencies indicated that continued improving budget balances and a declining debt burden could lead to a credit rating upgrade.

- According to the credit rating agencies, the Province’s credit rating benefits from Ontario’s large and diversified economy, high liquidity, prudent debt management program, stable federal transfers and its flexibility to adjust both tax policy and program spending. Credit rating agencies also identified challenges that negatively impact Ontario’s credit rating, including weak macroeconomic conditions, the Province’s elevated debt burden and spending pressures.

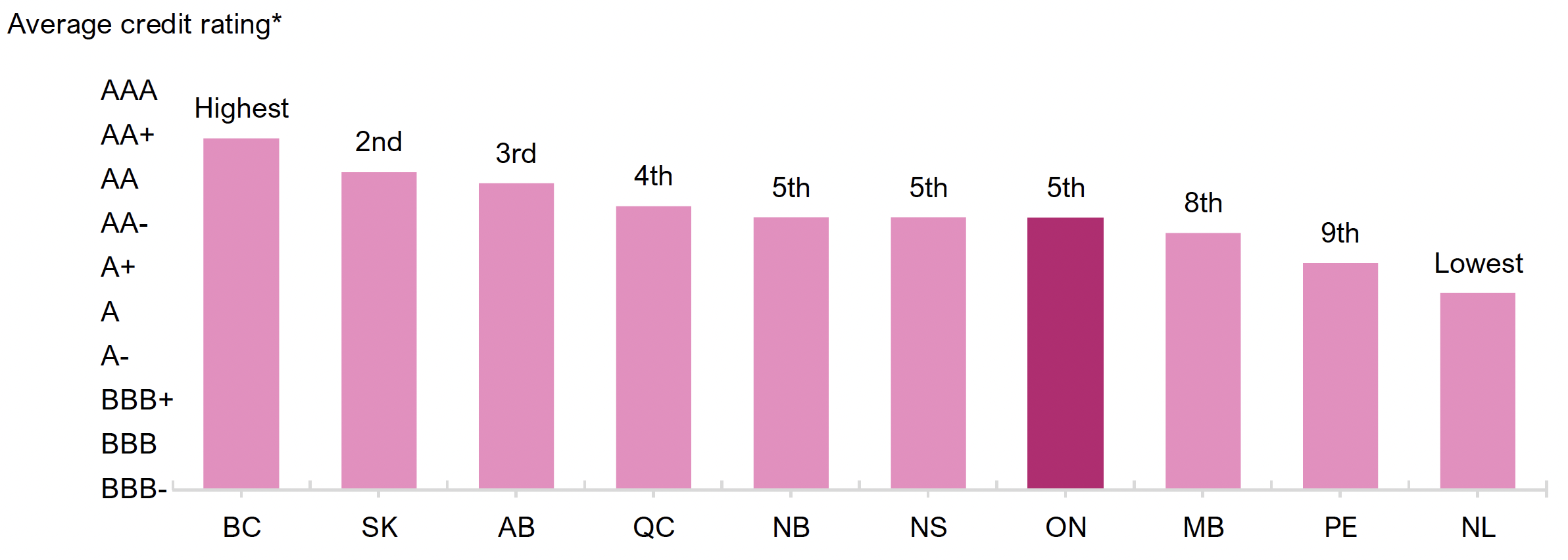

- Ontario’s average credit rating was the fifth highest among the provinces, tied with New Brunswick and Nova Scotia, and lower than the credit ratings of British Columbia, Saskatchewan, Alberta and Quebec. The upgrade in Ontario’s credit rating by DBRS led to an improvement in the Province’s relative ranking compared to the FAO’s 2023-24 report,[3] when it was the sixth highest ranked province.

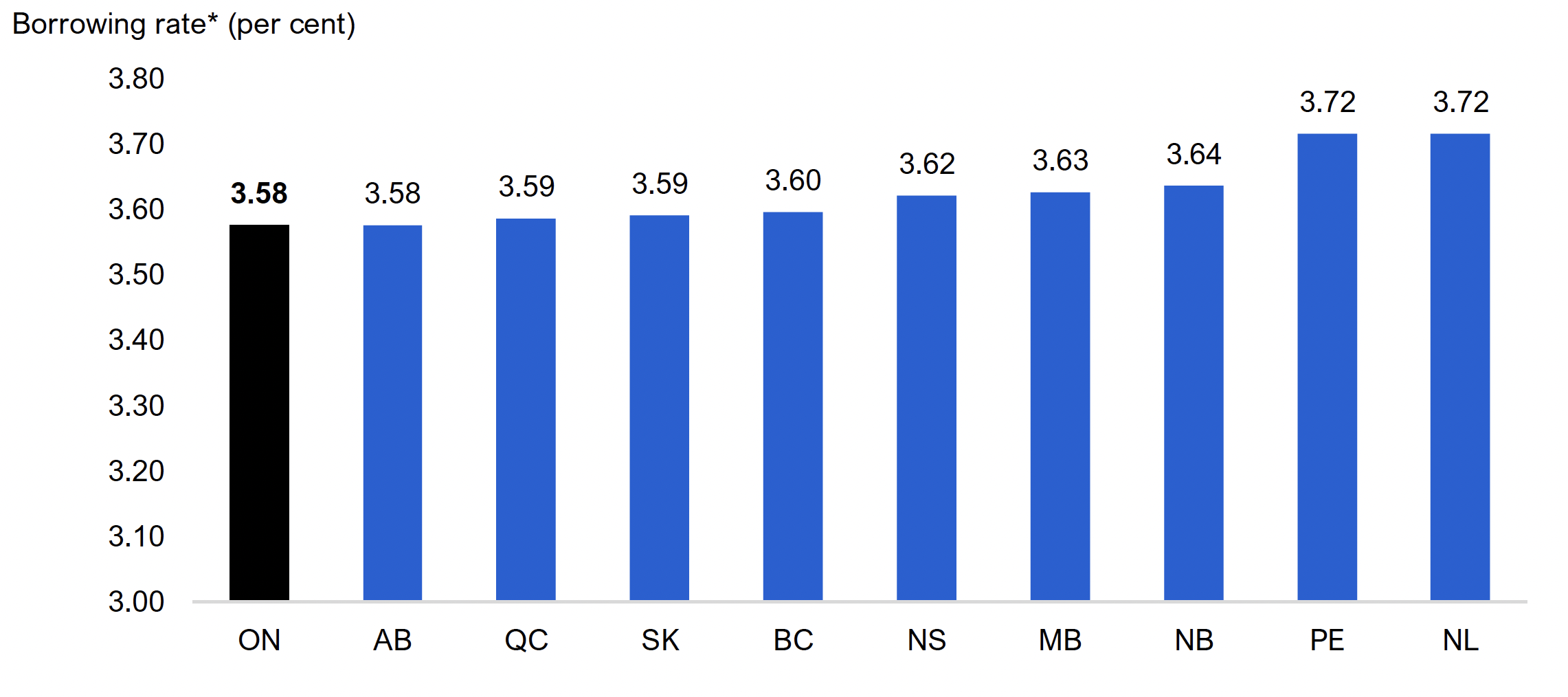

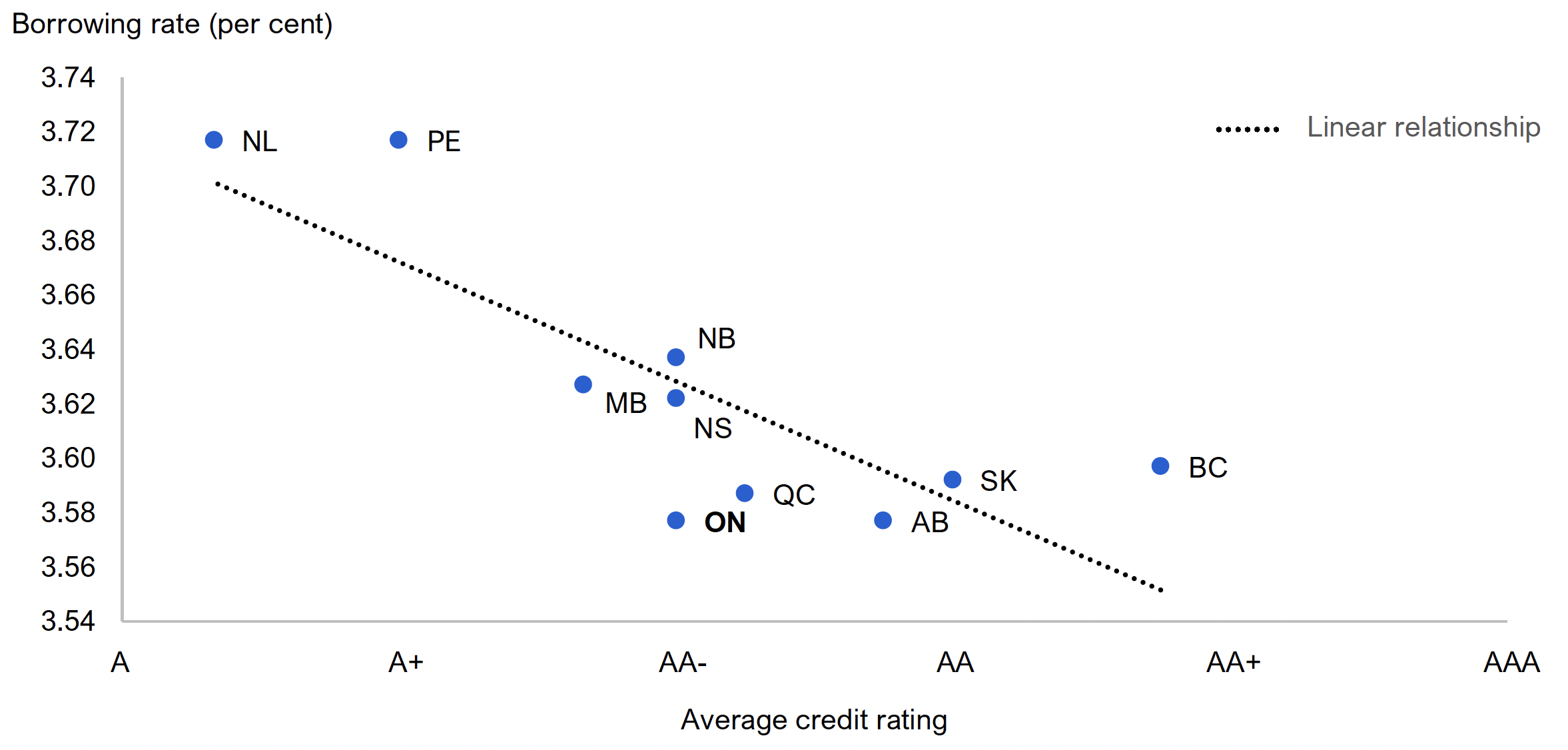

- Despite having the fifth highest credit rating among the provinces, Ontario has the lowest borrowing rate (tied with Alberta). Although provinces with higher credit ratings typically have lower borrowing rates, Ontario’s low borrowing rate is supported by other factors such as the high liquidity of its bonds.

Introduction

The Government of Ontario’s (the Province’s) debt is rated by four principal international credit rating agencies: Fitch Ratings (Fitch), Moody’s Investors Service (Moody’s), Morningstar DBRS (DBRS) and S&P Global Ratings (S&P). These agencies issue credit ratings that reflect their assessments of the Province’s ability to meet its debt-related financial obligations, Ontario’s economic and financial outlook, and future risks. In addition to credit ratings, credit rating agencies issue outlooks, which indicate the potential direction of a borrower’s credit rating within the next two years.[4] Credit rating agencies typically update their assessments each year.

Investors use credit ratings to assess risks related to the Province’s debt obligations. This risk is reflected in the interest rate paid by the Province. Generally, higher credit ratings are associated with lower borrowing costs, while lower ratings are associated with higher borrowing costs.

The FAO’s credit rating report provides an overview of Ontario’s current credit rating and outlook, and summarizes the common themes that the four credit rating agencies have highlighted that positively and negatively contribute to Ontario’s credit rating. The report also examines how Ontario’s credit rating and borrowing rates compare to other Canadian provinces.

Ontario’s credit rating

In June 2024, DBRS upgraded Ontario’s credit rating from AA- to AA.[5] The upgrade followed DBRS’ June 2023 change in the Province’s outlook from stable to positive.[6] DBRS indicated that the credit rating upgrade was supported by the Province’s continued fiscal discipline and key financial risk metrics, including its debt burden.[7] The Province’s overall fiscal results remained consistent with DBRS’ earlier expectations, despite a modestly weaker near-term fiscal outlook and higher borrowing needs.

Fitch (AA-), Moody’s (AA-) and S&P (A+) each reaffirmed their previous credit ratings for the Province in updated assessments. In general, Ontario continues to be rated as an extremely strong, investment-grade borrower.[8]

Figure 1 Ontario is generally rated as an extremely strong, investment-grade borrower

* See Table 1 for the credit ratings and Table 2 for the FAO’s credit rating conversion table. The credit rating agencies’ outlooks are shown in brackets.

Source: Fitch, Moody’s, DBRS, S&P and FAO.

While Moody’s and S&P’s credit ratings for Ontario were unchanged in 2024, both agencies maintained their positive outlooks[9] for the Province, indicating that continued fiscal progress could lead to a credit rating upgrade. More specifically:

- Moody’s is looking for the Province to continue recording declines in both its debt burden and deficits; and

- S&P is looking for the Province to continue to maintain operating surpluses, in addition to declines in after-capital deficits[10] and its debt-to-revenue ratio.

Factors impacting Ontario’s credit rating

The credit rating agencies highlighted both positive and negative factors that contributed to Ontario’s credit rating.

Positive factors contributing to Ontario’s credit rating

Credit rating agencies indicated that Ontario’s strong credit rating is supported by its large and diversified economy, high liquidity and prudent debt management program. As well, Canada’s federal-provincial framework provides provinces with the flexibility to adjust both tax policy and program spending, in addition to continued and predictable revenue from federal transfers.

Economy

Ontario has a large and diversified economy, which includes both manufacturing and services sectors, as well as strong trade relationships throughout North America and globally. The provincial economy also benefits from its favourable demographics and wealth factors, including its high net international in-migration and its high Gross Domestic Product (GDP) per capita. Fitch, Moody’s and S&P also highlighted the Province’s attraction of investments from global electric vehicle automakers and battery suppliers. These factors contribute to reliable and robust revenue generation for the Province.

Liquidity and debt management

The Province maintains large liquidity reserves to ensure it can meet its short-term obligations in periods of financial market stress. The Province also has strong access to both domestic and international borrowing markets, and a prudent debt management program, which aims to limit the impact of risks related to refinancing, changes in interest rates and exchange rate fluctuations on its debt.[11]

Federal-provincial framework

Under Canada’s federal-provincial framework, Ontario has considerable fiscal flexibility to adjust both tax policy and program spending, giving it the ability to raise revenues or decrease spending to meet fiscal challenges. The Province also receives continued and predictable federal transfers, which supplement own-source revenues (i.e., tax revenues, net income from government business enterprises and other non-tax revenues). Additionally, credit rating agencies regard the high likelihood of extraordinary support from the federal government in the event of a crisis as having a positive impact on the Province’s credit rating.

Negative factors contributing to Ontario’s credit rating

Credit rating agencies also identified challenges that negatively impact Ontario’s credit rating, including weak macroeconomic conditions, the Province’s elevated debt burden and spending pressures.

Macroeconomic conditions

The Province continues to face challenges due to the weak domestic and global macroeconomic outlook that could negatively impact its fiscal outcomes. Factors such as high interest rates, persistent inflation, slowing global trade and ongoing geopolitical instability are downward risks to the Province’s fiscal projections that may result in weaker revenue growth, higher spending and an increasing debt burden.

Debt burden

Ontario’s debt burden, which measures net debt as a share of GDP or revenues, is high relative to other regional governments of comparable credit ratings. Credit rating agencies highlighted the Province’s capital expenditure plan as a factor contributing to Ontario’s high debt burden, which is expected to remain elevated despite improvements in budgetary performance. The elevated debt burden means that if interest rates remain higher for longer than expected, the Province may face greater budgetary pressure from increased interest on debt expense.

Spending pressures

The government faces spending pressures from growing service demands driven by strong population growth, along with public sector wage and salary demands caused by high inflation, health care sector staffing shortages and retroactive wage increases related to Bill 124.[12] Moody’s noted that the Province may underestimate the costs to address these spending pressures, while also highlighting potential policy pressures that arise from increased demand for social support programs due to affordability concerns, particularly housing affordability. These factors could lead to budgetary outcomes that are worse than the government’s projections.

Ontario’s credit rating relative to other provinces

Ontario’s average credit rating was the fifth highest among the provinces, tied with New Brunswick and Nova Scotia, and lower than the credit ratings of British Columbia, Saskatchewan, Alberta and Quebec. The upgrade in Ontario’s credit rating by DBRS led to an improvement in the Province’s relative ranking compared to the FAO’s 2023-24 report, when it was the sixth highest ranked province.

Figure 2 Ontario tied with New Brunswick and Nova Scotia for the fifth highest average credit rating

* See Table 1 for the credit ratings and Table 2 for the FAO’s credit rating conversion.

Source: Fitch, Moody’s, DBRS, S&P and FAO.

In addition to Ontario, several other provinces received credit rating and outlook changes since the FAO’s 2023-24 report:

- Alberta was upgraded by both Fitch[13] and S&P,[14] and its outlook was revised from stable to positive by Moody’s.[15] These changes reflected improvements in Alberta’s fiscal performance, supported by high oil prices, spending restraint and the new fiscal framework introduced in Alberta’s 2023 budget.[16]

- British Columbia was downgraded by S&P,[17] which maintained a negative outlook, while Moody’s outlook for British Columbia was revised from stable to negative.[18] S&P’s decision reflected their assessment that British Columbia’s continued high levels of operating and capital spending set out in its 2024 budget will lead to increased deficits and debt levels. Moody’s reflected similar issues in addition to concerns about British Columbia’s spending obligations and lack of commitment to return to fiscal balance.

- New Brunswick was upgraded by Moody’s,[19] reflecting its ongoing strong fiscal management, which Moody’s expects will lead to positive budgetary results and stabilized debt and interest burdens. Moody’s also highlighted population growth as a favourable factor for New Brunswick’s economy.

Credit ratings and provincial borrowing costs

Investors use credit ratings to assess the creditworthiness of a borrower, with higher credit ratings typically reflected in lower borrowing costs.[20] However, Ontario benefits from the lowest borrowing rate[21] among all provinces (tied with Alberta), despite having the fifth highest average credit rating.[22] Ontario’s lower borrowing rate relative to the other provinces reflects a number of factors, including the high liquidity of its debt, which may be more important to some investors than the Province’s overall credit rating.[23]

Figure 3 Ontario’s borrowing rate lowest among all provinces, tied with Alberta

* Borrowing rates are shown as the yields on 10-year bonds, as of September 16, 2024.

Source: Information provided by the Province and FAO.

Appendix A

| Province | S&P | DBRS | Moody’s | Fitch | Average Rating* (1 = highest rating) |

|---|---|---|---|---|---|

| British Columbia | AA- (negative) | AA high (stable) | Aaa (negative) | AA+ (stable) | 2.25 |

| Alberta | AA- (stable) | AA (stable) | Aa2 (positive) | AA (stable) | 3.25 |

| Saskatchewan | AA (stable) | AA low (stable) | Aa1 (stable) | AA (stable) | 3.00 |

| Manitoba | A+ (stable) | A high (stable)** | Aa2 (stable) | 4.33 | |

| Ontario | A+ (positive) | AA (stable) | Aa3 (positive) | AA- (stable) | 4.00 |

| Quebec | AA- (stable) | AA low (stable) | Aa2 (stable) | AA- (stable) | 3.75 |

| New Brunswick | A+ (positive) | A high (stable) | Aa1 (stable) | 4.00 | |

| Nova Scotia | AA- (stable) | A high (stable)** | Aa2 (stable) | 4.00 | |

| Newfoundland & Labrador | A (stable) | A (stable) | A1 (stable) | 5.67 | |

| Prince Edward Island | A (positive) | A (stable) | Aa2 (stable) | 5.00 |

| Rating Description | Credit Quality | S&P | DBRS | Moody’s | Fitch | |

|---|---|---|---|---|---|---|

| Long Term | Long Term | Long Term | Long Term | Ranking | ||

| Investment-grade | Extremely Strong | AAA | AAA | Aaa | AAA | 1 |

| AA+ | AA high | Aa1 | AA+ | 2 | ||

| AA | AA | Aa2 | AA | 3 | ||

| AA- | AA low | Aa3 | AA- | 4 | ||

| Very Strong | A+ | A high | A1 | A+ | 5 | |

| A | A | A2 | A | 6 | ||

| A- | A low | A3 | A- | 7 | ||

| Strong | BBB+ | BBB high | Baa1 | BBB+ | 8 | |

| BBB | BBB | Baa2 | BBB | 9 | ||

| BBB- | BBB low | Baa3 | BBB- | 10 | ||

| Non-investment-grade | Speculative | BB+ | BB high | Ba1 | BB+ | 11 |

| BB | BB | Ba2 | BB | 12 | ||

| BB- | BB low | Ba3 | BB- | 13 | ||

| B+ | B high | B1 | B+ | 14 | ||

| B | B | B2 | B | 15 | ||

| B- | B low | B3 | B- | 16 | ||

| CCC | CCC | Caa | CCC | 17 |

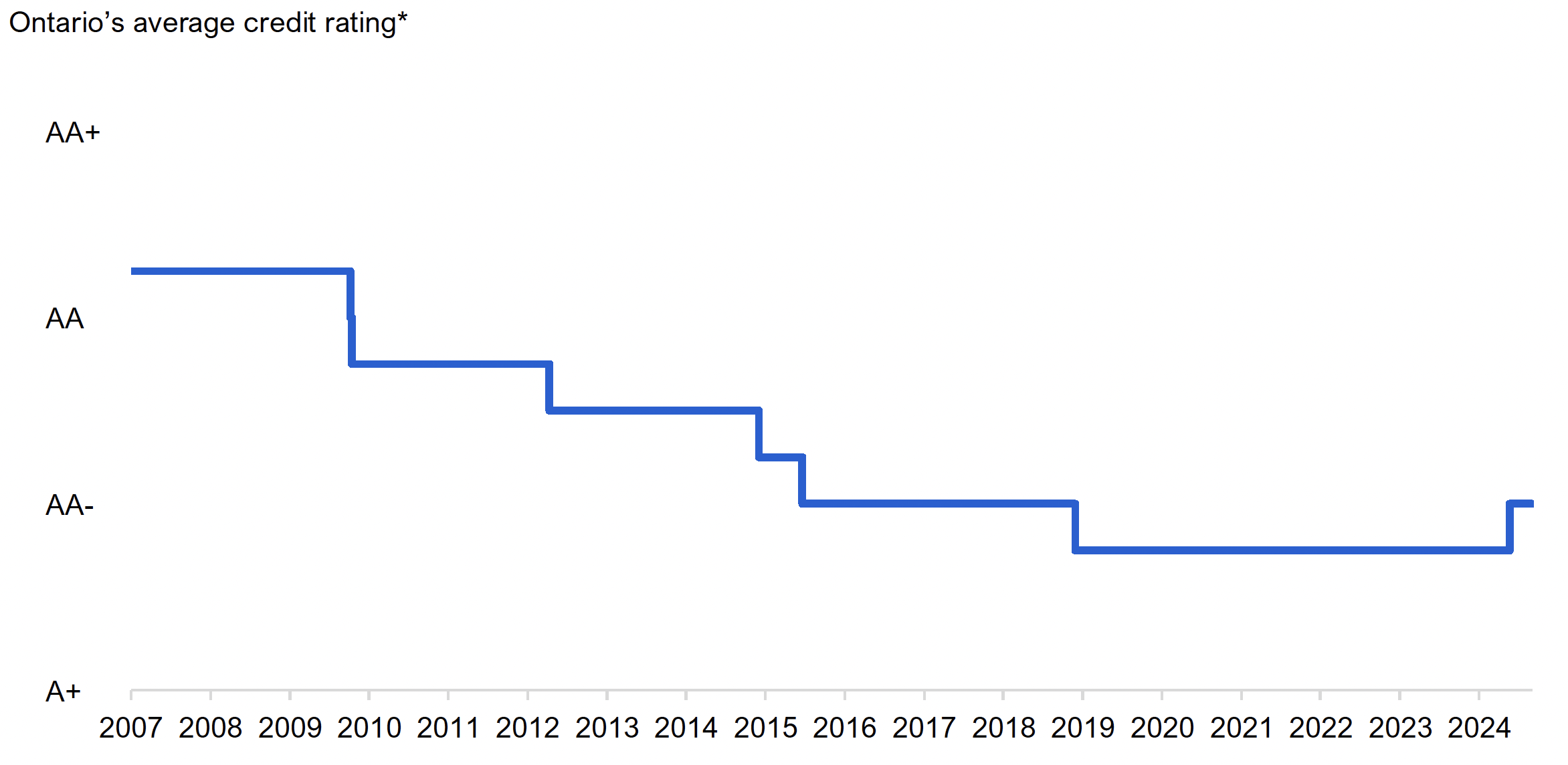

Figure 4 Ontario’s average credit rating since 2007

* See Table 2 for the FAO’s credit rating conversion.

Note: Data from January 17, 2007 to October 25, 2024.

Source: Fitch, Moody’s, DBRS, S&P and FAO.

Figure 5 Provinces with higher credit ratings tend to have lower borrowing rates

* See Table 1 for the credit ratings and Table 2 for the FAO’s credit rating conversion.

Note: Borrowing rates are for 10-year bonds as of September 16, 2024.

Source: Information provided by the Province, Fitch, Moody’s, DBRS, S&P and FAO.

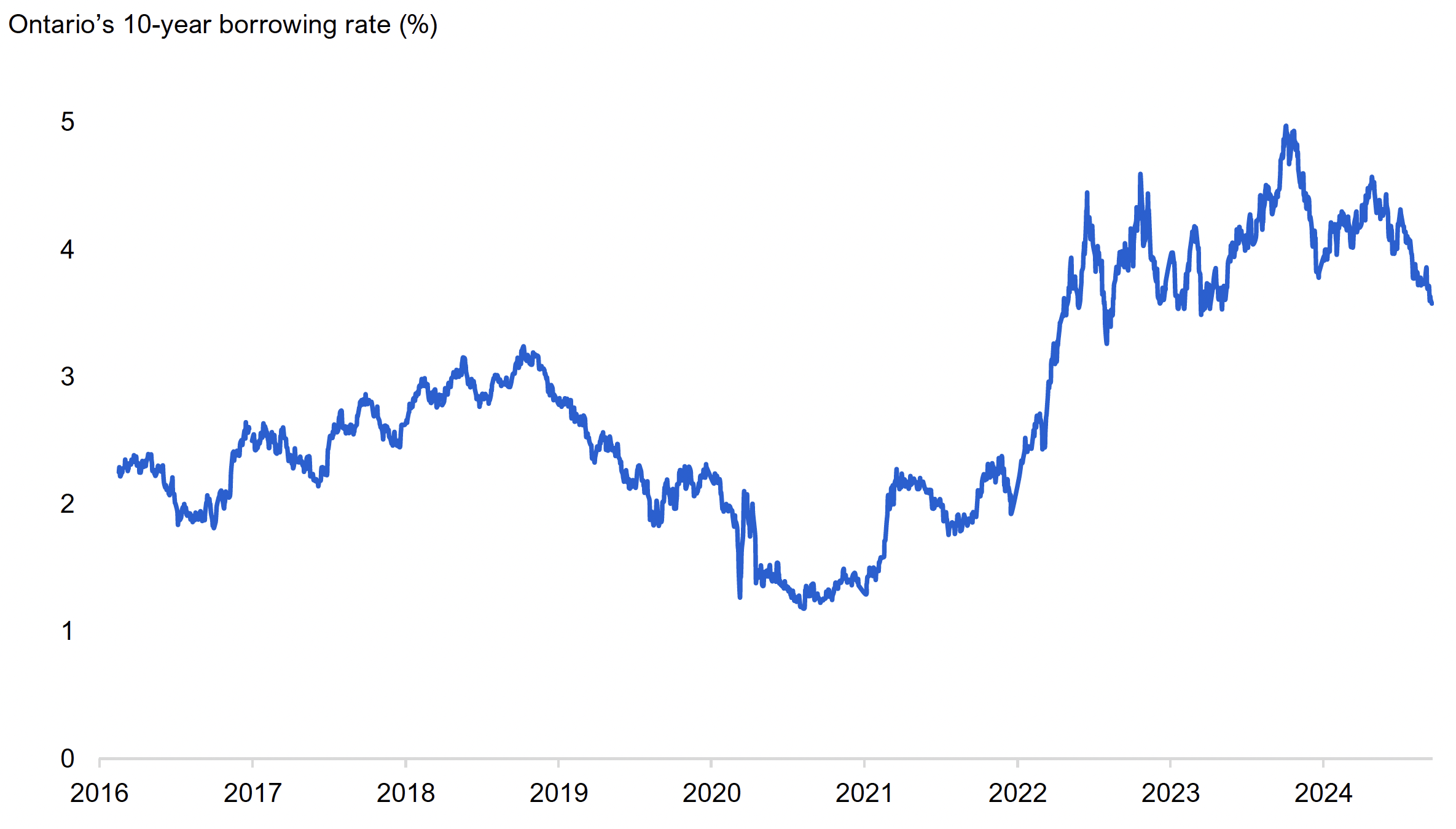

Figure 6 Ontario’s 10-year borrowing rate since 2016

Source: Information provided by the Province and FAO.

Graphical Descriptions

| Credit rating agency | Standardized rating* |

|---|---|

| DBRS | AA (stable) |

| Moody’s | AA- (positive) |

| Fitch | AA- (stable) |

| S&P | A+ (positive) |

| Province | Average credit rating* |

|---|---|

| BC | 2.25 |

| SK | 3.00 |

| AB | 3.25 |

| QC | 3.75 |

| NB | 4.00 |

| NS | 4.00 |

| ON | 4.00 |

| MB | 4.33 |

| PE | 5.00 |

| NL | 5.67 |

| Province | Borrowing rate* (per cent) |

|---|---|

| ON | 3.58 |

| AB | 3.58 |

| QC | 3.59 |

| SK | 3.59 |

| BC | 3.60 |

| NS | 3.62 |

| MB | 3.63 |

| NB | 3.64 |

| PE | 3.72 |

| NL | 3.72 |

| From | To | Ontario’s average credit rating* |

|---|---|---|

| 2007-01-17 | 2009-10-21 | 2.75 |

| 2009-10-22 | 2009-10-28 | 3.00 |

| 2009-10-29 | 2012-04-25 | 3.25 |

| 2012-04-26 | 2014-12-18 | 3.50 |

| 2014-12-19 | 2015-07-05 | 3.75 |

| 2015-07-06 | 2018-12-12 | 4.00 |

| 2018-12-13 | 2024-06-05 | 4.25 |

| 2024-06-06 | 2024-10-25 | 4.00 |

| Province | Average credit rating* | Borrowing rate (per cent) |

|---|---|---|

| BC | 2.25 | 3.60 |

| SK | 3.00 | 3.59 |

| AB | 3.25 | 3.58 |

| QC | 3.75 | 3.59 |

| NS | 4.00 | 3.62 |

| ON | 4.00 | 3.58 |

| NB | 4.00 | 3.64 |

| MB | 4.33 | 3.63 |

| PE | 5.00 | 3.72 |

| NL | 5.67 | 3.72 |

This chart shows Ontario’s 10-year borrowing rate (in per cent) from February 16, 2016 to September 16, 2024. The bond rate increased from 2.25% in February 2016 to 3.24% in October 2018, before declining to 1.18% in August 2020. It then rose to 3.94% in May 2022, and has fluctuated between 3.26% and 4.97% from May 2022 to September 2024.

Footnotes

[1] This report reflects available information as of October 25, 2024 unless otherwise noted.

[2] Based on a standardized scale. See Table 2 for the FAO’s credit rating conversion.

[3] See the FAO’s Ontario's Credit Rating: Fall 2023 Update for more details.

[4] An outlook can be stable, negative or positive. A stable outlook indicates a low likelihood of a credit rating change, a negative outlook indicates that the credit rating is likely to be lowered, and a positive outlook indicates that the credit rating is likely to be raised. While a positive or negative outlook indicates the direction of a potential credit rating change, it does not guarantee a change.

[5] See DBRS’ Ontario Rating Action Press Release for more details.

[6] See DBRS’ Ontario Press Release on June 08, 2023 for more details.

[7] Credit rating agencies typically make adjustments to the Province’s reported financial information. DBRS’ adjusted debt includes net tax-supported debt and unfunded pension liabilities. See DBRS’ Rating Canadian Provincial and Territorial Governments for the methodology.

[8] See Figure 4 for Ontario’s average credit rating history.

[9] S&P changed the Province’s outlook from stable to positive in June 2023 (see S&P’s Province of Ontario Outlook Revised To Positive From Stable On Strong Budgetary Performance; 'A+' Ratings Affirmed for more details), while Moody’s changed the Province’s outlook from stable to positive in May 2023 (see Moody's changes Ontario's outlook to positive; affirms Aa3 rating for more details).

[10] S&P adjusts operating balances to recognize capital expenditures as incurred rather than as amortized.

[11] Refinancing risk is the risk that a borrower will not be able to borrow to repay existing debt. Interest rate risk is the risk that movements in interest rates will increase debt servicing costs. Exchange rate risk is the risk that movements in exchange rates of foreign-denominated debt will increase debt servicing costs. For details on how Ontario manages these risks, see Ontario Financing Authority’s Risk Management.

[12] Bill 124 refers to the Protecting a Sustainable Public Sector for Future Generations Act, 2019, which limited base salary increases for most provincial employees to one per cent per year for a period of three years. Bill 124 was ultimately repealed by the government and public sector employees have been awarded retroactive compensation as a result.

[13] See Fitch’s Alberta Rating Action Commentary for more details.

[14] See S&P’s Province of Alberta Upgraded To 'AA-' From 'A+' On Strong Fiscal Performance; Outlook Stable for more details.

[15] See Moody’s Alberta Rating Action for more details.

[16] The new fiscal framework requires annual balanced budgets and a portion of any surpluses recorded to be allocated towards debt repayment, among others. For more information, see page 17 of Alberta’s 2023-26 Fiscal Plan.

[17] See S&P’s Province of British Columbia Downgraded To 'AA-' From 'AA' On Continued Fiscal Weakening; Outlook Negative for more details.

[18] See Moody’s British Columbia Rating Action for more details.

[19] See Moody’s New Brunswick Rating Action for more details.

[20] See Figure 5.

[21] Borrowing rate is represented by the yield on 10-year bond.

[22] In the FAO’s 2023-24 report, Ontario had the third lowest borrowing rate behind Quebec and British Columbia. See Figure 6 for Ontario’s 10-year borrowing rate since 2016.

[23] For further information, see Cantor and Packer (1996), Determinants and Impacts of Sovereign Credit Ratings, Federal Reserve Bank of New York Economic Policy Review, 37-54, and Cantor, Packer and Cole (1997), Split Ratings and the Pricing of Credit Risk, Federal Reserve Bank of New York, Research Paper No. 9711.