Highlights

- This report provides information on unaudited spending by the Province through the end of the 2020-21 fiscal year (March 31, 2021), including:

- changes to the 2020-21 spending plan;

- unaudited spending results compared to planned spending;

- an updated budget deficit projection for 2020-21; and

- top-ups to, and transfers from, the Province’s three unallocated funds: the COVID-19 Health Sector Response Fund (Health Fund), the Support for People and Jobs Fund (SPJF) and the Contingency Fund.

- The Province started the 2020-21 fiscal year with a spending plan of $165.2 billion.[1] During the year, the spending plan increased by $22.1 billion (13.4 per cent). In the first and second quarters of 2020-21, the Province added $759 million and $13.8 billion, respectively, in planned spending, while in the fourth quarter the Province added another $7.5 billion. Key fourth quarter changes included:

- The ‘other programs’ sector received a $5.7 billion (18.3 per cent) spending plan increase in the fourth quarter, including $3.4 billion to fund the Ontario Small Business Support Grant, $0.6 billion for public transit infrastructure and $0.5 billion in additional support for municipal operations.

- The education sector spending plan increased by $1.6 billion (4.9 per cent), due to funding from phase two of the federal Safe Return to Class Fund and the Ontario COVID-19 Child Benefit program.

- The health sector increased by $1.4 billion (2.0 per cent), primarily for the operation of hospitals ($1.9 billion increase) and other programs, which was partially offset by a $1.5 billion spending plan decrease for payments to physicians.

- Although the Province increased its 2020-21 spending plan during the year by $22.1 billion to $187.3 billion, by the end of 2020-21 unaudited spending was only $177.0 billion. Overall, this was $10.3 billion, or 5.5 per cent, less than planned.

- All sectors spent less than planned, led by ‘other programs’ ($3.7 billion or 10 per cent under plan), interest on debt ($1.1 billion or 9.1 per cent under plan) and health ($1.0 billion or 1.5 per cent under plan). There was also a $3.4 billion end-of-year balance in the Contingency Fund that was not spent.

- Spending information for all of the Province’s programs by ministry is available on the FAO’s website at: https://bit.ly/3kfuDm2.

- Compared to 2019-20, spending in 2020-21 was up $21.3 billion, or 13.7 per cent. The year-over-year spending increase is significantly above the recent average annual growth rate and reflects government spending in response to the COVID-19 pandemic.

- ‘Other programs’ ($9.9 billion or 41.9 per cent increase), health ($9.3 billion or 15.5 per cent increase) and education ($2.6 billion or 8.2 per cent increase) had the largest year-over-year spending increases compared to 2019-20.

- Spending on postsecondary education ($0.3 billion decrease), justice ($57 million decrease) and interest on debt ($0.3 billion decrease) was lower in 2020-21 compared to spending in 2019-20.

- Using updated revenue and spending information, the FAO projects the 2020-21 budget deficit will be $29.3 billion. This is an improvement of $9.2 billion compared to the Province’s 2020-21 budget deficit projection of $38.5 billion in the 2021 Ontario Budget.

- The FAO estimates that 2020-21 total revenue will be $2.7 billion higher than forecast by the Province in the 2021 budget, as the outlook for the Ontario economy has improved since the preparation of the 2021 budget.

- The FAO’s projection for total expense is $6.5 billion lower than the expense forecast in the 2021 budget. The difference in the two spending forecasts reflects the more up-to-date information available to the FAO (as of April 22, 2021) compared to the spending forecast used by the Province in the 2021 budget.

- The Province started the 2020-21 fiscal year with a combined $5.1 billion in unallocated funds through the Health Fund, the SPJF and the Contingency Fund.

- The Province added $14.7 billion to the three funds during the year, bringing total funds available to $19.8 billion.

- The Province transferred $2.5 billion from the three unallocated funds to various programs in the first quarter, $1.6 billion in the second quarter, $7.1 billion in the third quarter and $5.2 billion in the fourth quarter. After accounting for these transfers, the remaining year-end balances in the Health Fund and SPJF were zero, while the remaining balance in the Contingency Fund was $3.4 billion.

Introduction

This report provides information on spending by the Government of Ontario (the Province) through the end of the 2020-21 fiscal year. The report:

- identifies changes to the Province’s 2020-21 spending plan;

- reviews unaudited spending in 2020-21 against both the 2020-21 spending plan and spending in 2019-20;

- projects the 2020-21 budget deficit; and

- tracks top-ups to, and transfers from, the Province’s three unallocated funds: the COVID-19 Health Sector Response Fund (Health Fund), the Support for People and Jobs Fund (SPJF) and the Contingency Fund.

The information in this report is based on the FAO’s analysis of the March 2020 Economic and Fiscal Update (the March 2020 Update), the 2020-21 Expenditure Estimates, the Supplementary Estimates, 2020-21 (Volume 1 and 2nd Edition), the 2021 Ontario Budget, and transactions recorded in the Province’s Integrated Financial Information System (IFIS) as of April 22, 2021.

The closing date for spending transactions related to the 2020-21 fiscal year, which ended on March 31, 2021, was April 22, 2021. However, there will still be 2020-21 spending transactions that are recorded between April 22, 2021 and when the 2020-21 Public Accounts of Ontario are released (typically in September). Depending on the nature of these transactions, there may be material changes from the information presented in this report and the 2020-21 Public Accounts of Ontario.[2]

Changes to the 2020-21 Spending Plan

Overview

In the March 2020 Update, the Province presented a spending plan for the 2020-21 fiscal year of $165.2 billion.[3] By the end of the 2020-21 fiscal year, the Province’s spending plan had increased by $22.1 billion, or 13.4 per cent, to $187.3 billion. In the first and second quarters of 2020-21, the Province added $759 million and $13.8 billion, respectively, in planned spending, while in the fourth quarter the Province added another $7.5 billion.

By sector, the largest spending plan increases went to ‘other programs’ ($12.4 billion, 50.2 per cent increase), health ($8.4 billion, 13.6 per cent increase) and education ($2.6 billion, 8.2 per cent increase). The children’s and social services and justice sectors both received spending plan increases of $237 million during 2020-21, while the postsecondary education sector’s spending plan was reduced by $150 million during the year.

The Province started the 2020-21 year with a total of $5.1 billion in unallocated funds through three programs: the Health Fund, the SPJF and the Contingency Fund. After accounting for top-ups and transfers during the year, the remaining balances at the end of 2020-21 were $3.4 billion in the Contingency Fund and zero in the Health Fund and SPJF. (The final section of this report provides more information on the three unallocated funds.) As noted in the 2020 Ontario Budget, the remaining funds in the Contingency Fund will reduce both the budget deficit and Ontario’s net debt.[4]

Fourth Quarter Analysis[5]

In the fourth quarter, the Province added $7.5 billion to the 2020-21 spending plan. Most of the spending plan increase went to the ‘other programs’ sector ($5.7 billion), while the education sector increased by $1.6 billion and the health sector increased by $1.4 billion. There were smaller changes to the remaining program sectors, with planned spending in the justice and children’s and social services sectors up $189 million and $11 million, respectively, while the spending plan for the postsecondary education sector declined by $142 million.

The fourth quarter spending plan increases for the program sectors were partly funded through transfers from the Province’s three unallocated funds: the Health Fund ($229 million drawdown), the SPJF ($1.7 billion drawdown) and the Contingency Fund ($3.3 billion drawdown). However, the $3.3 billion transfer from the Contingency Fund was offset by a $4.0 billion top-up, increasing the Contingency Fund’s balance by a net $703 million.

Sector

2020-21 Spending Plan

Q1 Changes

Q2 Changes

Q3 Changes

Q4 Changes

Total Changes

Revised 2020-21 Spending Plan

Health

61,753

2,083

413

4,533

1,377

8,406

70,159

Education

31,358

-

5

994

1,580

2,580

33,937

Postsecondary Education

6,984

-

2

-10

-142

-150

6,834

Children's and Social Services

17,944

158

49

19

11

237

18,181

Justice

4,948

-

25

23

189

237

5,186

Other Programs

24,734

1,010

4,098

1,556

5,744

12,409

37,144

Unallocated Funds:

COVID-19 Health Sector Response Fund

1,823

-1,505

4,147

-4,237

-229

-1,823

-

Support for People and Jobs Fund

1,966

-629

1,699

-1,330

-1,706

-1,966

-

Contingency Fund

1,300

-359

3,340

-1,549

703

2,136

3,436

Interest on Debt

12,407

-

-

-

-

-

12,407

Total

165,217

759

13,780

-

7,528

22,067

187,283

Source: FAO analysis of the 2020-21 Expenditure Estimates, the Supplementary Estimates, 2020-21 and information provided by Treasury Board Secretariat.

The rest of this section highlights key fourth quarter spending plan changes by sector and vote-item. For information on all of the Province’s transfer payment programs and ministries, visit the FAO’s website at: https://bit.ly/3kfuDm2.

Health: $1,377 million (2.0 per cent) increase, including:

- $1,583 million increase for Health Services (Vote-Item 1416-1), which funds the operation of hospitals ($1,902 million increase), home care ($364 million decrease), community services (mental health, health centres and support, $149 million net decrease) and other services.

- $887 million increase for Programs and Administration (Vote-Item 1416-2) for regional coordination operations support ($708 million), digital health ($113 million) and cancer treatment services ($93 million).

- $230 million increase for Provincial Programs (Vote-Item 1412-1) for community and priority services.

- $172 million increase for Drug Programs (Vote-Item 1405-2), which funds a number of provincial drug programs, the largest of which is the Ontario Drug Benefit program.

- $1,491 million decrease for Ontario Health Insurance (Vote-Item 1405-1), which administers payments to physicians.

Education: $1,580 million (4.9 per cent) increase, including:

- $1,736 million increase for Elementary and Secondary Education Program – Policy and Program Delivery (Vote-Item 1002-1), largely for phase two of the federal Safe Return to Class Fund and the Ontario COVID-19 Child Benefit program.

- $94 million decrease for Child Care and Early Years – Policy Development and Program Delivery (Vote-Item 1004-1), largely for lower planned spending on the Childcare Access and Relief from Expenses (CARE) Tax Credit as a result of lower child care utilization during the COVID-19 pandemic.

Postsecondary Education: $142 million (2.0 per cent) decrease, including:

- $137 million decrease for Colleges, Universities and Student Support (Vote-Item 3002-1), which provides operating grants for colleges and universities ($174 million increase), and financial aid for students ($311 million decrease).

Justice: $189 million (3.8 per cent) increase, including:

- $65 million increase for Institutional Services (Vote-Item 2605-3), which funds the operation and maintenance of Ontario’s adult correctional institutions.

- $52 million increase for Ministry of the Attorney General – Ministry Administration (Vote-Item 301-1), which supports the administration of the ministry.

- $38 million increase for Ontario Provincial Police – Corporate and Strategic Services (Vote-Item 2604-1), which provides support services to front-line officers and investigative units of the Ontario Provincial Police (OPP).

- $33 million increase for Ministry of the Attorney General – Agency and Tribunal Relations (Vote-Item 303-4) to fund Ontario’s Long-Term Care COVID-19 Commission.

Other Programs: $5,744 million (18.3 per cent) increase, including:

- $3,400 million increase for Economic Development and Innovation (Vote-Item 902-13) to fund the Ontario Small Business Support Grant.

- $626 million increase for Urban and Regional Transportation (Capital) (Vote-Item 2702-3), which funds infrastructure investments in provincial ($497 million increase) and municipal ($115 million increase) public transit.

- $505 million increase for Municipal Services and Building Regulation (Vote-Item 1902-4), mainly to support municipal operating pressures in 2021 due to the COVID-19 pandemic. This funding is in addition to the $1.4 billion that was provided to municipalities for 2020 operating pressures as part of the federal-provincial Safe Restart Agreement.

- $414 million increase for Ontario Shared Services (Vote-Item 1811-5), largely for the procurement of personal protective equipment (PPE) and other COVID-19-related supplies.

- $348 million increase for Urban and Regional Transportation (Operating) (Vote-Item 2702-2) to provide additional operating subsidies to Metrolinx ($201 million) and municipal transit agencies ($150 million) to address budget pressures related to the COVID-19 pandemic. The funding for municipal transit agencies is in addition to the $2,000 million that was previously provided as part of the federal-provincial Safe Restart Agreement.

- $299 million increase for Community and Market Housing (Vote-Item 1904-2), largely for homelessness programs.

- $261 million increase for Employment Ontario System (Operating) (Vote-Item 1607-1), which funds the operation of the Employment Ontario program, which includes employment and training programs, the Ontario Apprenticeship Training Tax Credit, and the Ontario Co-operative Education Tax Credit.

- A net $163 million increase for 118 additional vote-items in the ‘other programs’ sector. For more information, visit the FAO’s website at: https://bit.ly/3kfuDm2.

- $272 million decrease for Infrastructure Programs (Capital) (4003-2), which funds infrastructure projects such as Municipal Infrastructure, Toronto Waterfront Revitalization, Broadband and Cellular Infrastructure, and Federal-Provincial Infrastructure Programs.

2020-21 Spending (Unaudited)

Unaudited Spending vs. Planned Spending

The Province spent $177.0 billion over the 2020-21 fiscal year. Overall, this is $10.3 billion, or 5.5 per cent, less than planned. In 2020-21, all sectors spent less than planned, led by ‘other programs’ ($3.7 billion or 10.0 per cent under plan), interest on debt ($1.1 billion or 9.1 per cent under plan), health ($1.0 billion or 1.5 per cent under plan), children’s and social services ($0.4 billion or 2.4 per cent under plan) and postsecondary education ($0.3 billion or 4.0 per cent under plan). There was also a $3.4 billion end-of-year balance in the Contingency Fund that was not spent.

The $10.3 billion in net savings will be used to reduce both the budget deficit and Ontario’s net debt.

Sector

Revised 2020-21 Spending Plan

2020-21 Unaudited Spending

Unaudited Spending vs. Revised Spending Plan

Unaudited Spending vs. Revised Spending Plan (%)

Health

70,159

69,131

-1,028

-1.5%

Education

33,937

33,780

-158

-0.5%

Postsecondary Education

6,834

6,563

-271

4.0%

Children's and Social Services

18,181

17,737

-444

-2.4%

Justice

5,186

5,080

-106

-2.0%

Other Programs

37,144

33,424

-3,719

10.0%

Unallocated Funds:

COVID-19 Health Sector Response Fund

-

-

-

N/A

Support for People and Jobs Fund

-

-

-

N/A

Contingency Fund

3,436

-

-3,436

-100%

Interest on Debt

12,407

11,279

-1,128

-9.1%

Total

187,283

176,994

-10,289

-5.5%

Source: FAO analysis of the 2020-21 Expenditure Estimates, the Supplementary Estimates, 2020-21 and information provided by Treasury Board Secretariat.

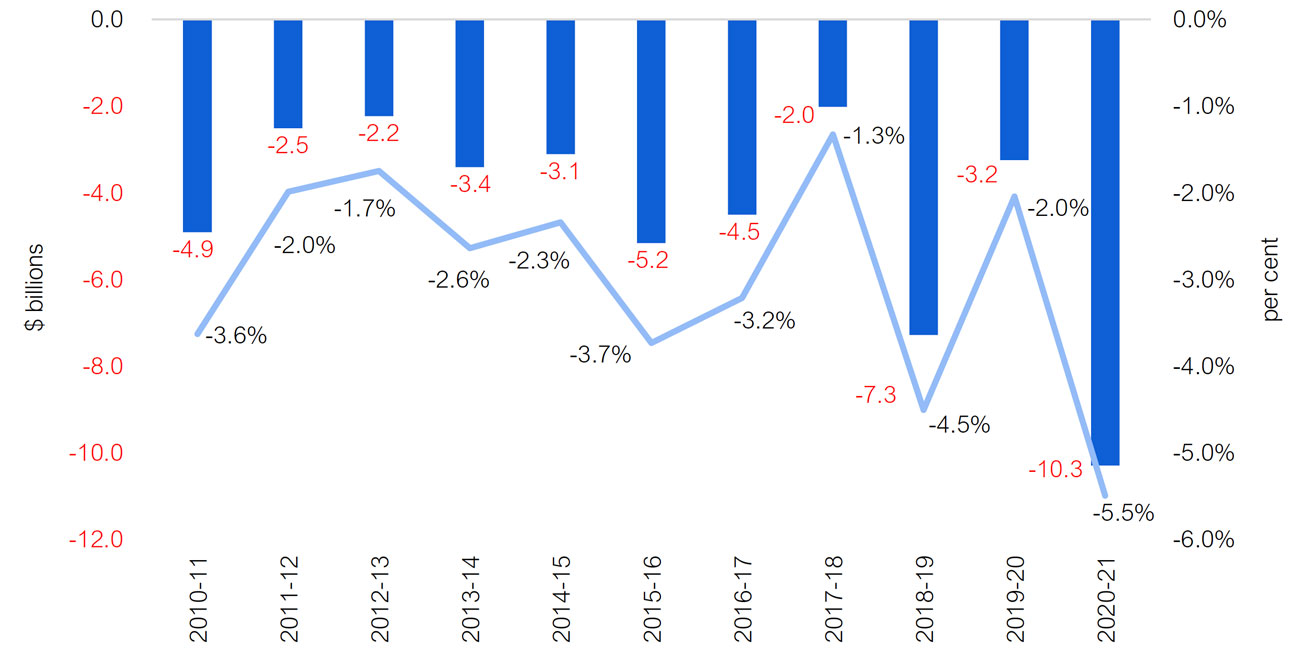

For context, the FAO compared the Province’s planned spending against actual spending for the last 10 years and found that actual spending was, on average, $3.8 billion or 2.7 per cent lower than planned. The savings each year ranged from $2.0 billion in 2017-18 to $7.3 billion in 2018-19. This indicates that savings in 2020-21 of $10.3 billion was significantly higher than over the previous 10 years. (On the other hand, overall spending in 2020-21 was still 13.7 per cent higher compared to 2019-20. See next section for more information.)

Figure 1: Annual spending savings: actual spending less planned spending, 2010-11 to 2020-21

Note: Figures exclude additional spending by the broader public sector organizations controlled by the Province (hospitals, school boards and colleges), the Province’s agencies and the legislative offices. The FAO has adjusted some totals to reflect in-year accounting adjustments so that planned and actual spending are on the same basis.

Source: FAO analysis of the Public Accounts of Ontario and the Expenditure Estimates.

The rest of this section highlights key vote-item unaudited spending compared to the revised 2020-21 spending plan. For information on spending by all of the Province’s transfer payment programs and ministries, visit the FAO’s website at: https://bit.ly/3kfuDm2.

Health sector spending: $1,028 million (1.5 per cent) below plan, including:

- $63 million below plan in Provincial Programs (Vote-Item 1412-1), which funds a variety of specialized programs, such as Canadian Blood Services and Community and Priority Services.

- $75 million below plan in Ontario Health Insurance (Vote-Item 1405-1), which administers payments to physicians.

- $79 million below plan in Health Services (Vote-Item 1416-1), which funds the operation of hospitals, home care, community services (mental health, health centres and support) and other services.

- $95 million below plan in Long-Term Care Homes Program (Operating) (Vote-Item 4502-1), which funds the operation and development of long-term care homes.

- $254 million below plan in Programs and Administration (Vote-Item 1416-2), largely for regional coordination operations support.

- $368 million below plan in Population and Public Health (Vote-Item 1406-4), for outbreaks of diseases ($141 million below plan), Public Health Ontario ($127 million below plan) and other programs.

Education sector spending: $158 million (0.5 per cent) below plan, including:

- $57 million below plan in Child Care and Early Years – Policy Development and Program Delivery (Vote-Item 1004-1), which includes transfer payments to support child care and the Childcare Access and Relief from Expenses (CARE) Tax Credit.

- $65 million below plan in Elementary and Secondary Education Program – Policy and Program Delivery (Vote-Item 1002-1), which mainly funds school boards.

Postsecondary Education sector spending: $271 million (4.0 per cent) below plan, including:

- $235 million below plan in Colleges, Universities and Student Support (Vote-Item 3002-1), which provides operating grants for colleges and universities, and financial aid for students.

Children’s and Social Services sector spending: $444 million (2.4 per cent) below plan, including:

- $144 million below plan in Supports to Individuals and Families (Vote-Item 702-21), which administers a variety of programs such as Residential Services, Autism, and Child and Youth Community Supports.

- $231 million below plan in Financial and Employment Supports (Vote-Item 702-3), which includes the Ontario Disability Support Program, Ontario Works and the Ontario Drug Benefit Plan.

Other Programs sector spending: $3,719 million (10.0 per cent) below plan, including:

- $97 million below plan in Vote-Item 2704-18, for the amortization expense of provincial highway infrastructure assets.

- $112 million below plan in Energy Development and Management – Policy and Programs (Vote-Item 2205-1), largely for the energy costs component of the Property Tax and Energy Costs Rebate Grants program.

- $150 million below plan in Employment Ontario System (Vote-Item 1607-1) for employment and training programs and the Ontario Jobs Training Tax Credit.

- $245 million below plan in Ontario Electricity Financial Corporation Dedicated Electricity Earnings (Vote-Item 1203-12), which reflects the transfer of dedicated electricity earnings from the Province to the Ontario Electricity Financial Corporation.

- $261 million below plan in Vote 3403 for employee and pensioner benefits.

- $302 million below plan in Tax and Benefits Administration (Vote-Item 1209-1), largely for the property tax component of the Property Tax and Energy Costs Rebate Grants program.

- $306 million below plan in Urban and Regional Transportation (Operating) (Vote-Item 2702-2), largely for Metrolinx operating subsidies.

- $1,656 million below plan in Urban and Regional Transportation (Capital) (Vote-Item 2702-3), largely for infrastructure investments in provincial ($1,345 million below plan) and municipal ($308 million below plan) public transit.

- A net $590 million below plan in the remaining 256 vote-items in the ‘other programs’ sector. For more information, visit the FAO’s website at: https://bit.ly/3kfuDm2.

2020-21 Spending vs. 2019-20 Spending

In 2020-21, the Province spent $177.0 billion, which is $21.3 billion, or 13.7 per cent, more than was spent in 2019-20. ‘Other programs’ ($9.9 billion), health ($9.3 billion), education ($2.6 billion), and children’s and social services ($0.3 billion) all spent more in 2020-21 compared to 2019-20. On the other hand, spending on postsecondary education (-$0.3 billion), interest on debt (-$0.3 billion) and justice (-$0.1 billion) was lower in 2020-21 compared to 2019-20.

Sector

2019-20 Actual Spending

2020-21 Unaudited Spending

2020-21 vs. 2019-20

2020-21 vs. 2019-20 (%)

Health

59,843

69,131

9,288

15.5%

Education

31,222

33,780

2,558

8.2%

Postsecondary Education

6,897

6,563

-333

-4.8%

Children's and Social Services

17,391

17,737

346

2.0%

Justice

5,137

5,080

-57

-1.1%

Other Programs

23,558

33,424

9,866

41.9%

Interest on Debt

11,610

11,279

-331

-2.9%

Total

155,657

176,994

21,337

13.7%

Source: FAO analysis of the 2020-21 Expenditure Estimates, the Supplementary Estimates, 2020-21 and information provided by Treasury Board Secretariat.

For context, the FAO estimates that from 2010-11 to 2019-20, spending increased by an annual average of only $2.8 billion or 2.1 per cent. For 2020-21, the $21.3 billion or 13.7 per cent spending increase is significantly above the recent average annual growth rate due to the COVID-19 pandemic.

- The $9,288 million, or 15.5 per cent, year-over-year spending increase in the health sector largely reflects government spending in response to the COVID-19 pandemic.[6] For context, the 15.5 per cent spending increase in 2020-21 is significantly higher than the health sector’s average annual growth rate of 3.2 per cent from 2010-11 to 2019-20.

- The $2,558 million, or 8.2 per cent, year-over-year spending increase in the education sector largely reflects government spending in response to the COVID-19 pandemic, including an estimated net $1,092 million increase in direct transfers to families, $691 million in federal Safe Return to Class funding and $234 million in provincial school reopening funding.[7]

- The postsecondary education sector spent $333 million, or 4.8 per cent, less in 2020-21 compared to 2019-20, largely due to lower spending in 2020-21 on student financial aid.

- The children’s and social services sector spent $346 million, or 2.0 per cent, more in 2020-21 compared to 2019-20. The year-over-year spending increase largely occurred in Support to Individuals and Families (Vote-Item 702-21), which administers a variety of programs such as Residential Services, Autism, and Child and Youth Community Supports.

- The $9,866 million, or 41.9 per cent, year-over-year spending increase in the ‘other programs’ sector largely reflects COVID-19-related spending:

- $3,459 million increase for the Ontario Small Business Support Grant.

- $2,652 million increase in operating support for Metrolinx ($491 million) and for municipal transit agencies ($2,161 million) to address budget pressures related to the COVID-19 pandemic.

- $1,890 million increase to support municipalities’ general operating pressures in connection with the COVID-19 pandemic.

- $778 million increase to defer a portion of the Global Adjustment charge for commercial and industrial ratepayers for the months of April, May and June, 2020; to temporarily suspend time-of-use electricity pricing at the “off-peak” rate from April 1, 2020 until May 31, 2020; to temporarily reduce electricity prices for residential, small business and farm customers who pay time-of-use and tiered rates from January 1, 2021 to February 22, 2021; and to provide support to individuals and small businesses through the COVID-19 Energy Assistance Program (CEAP).

- $718 million increase for homelessness programs, largely from the pandemic-related Social Services Relief Fund.

- $369 million increase in Ontario Shared Services (Vote-Item 1811-5) largely due to the procurement of personal protective equipment (PPE) and other COVID-19-related supplies.

- $165 million increase for the Property Tax and Energy Costs Rebate Grants program.

2020-21 Budget Deficit Projection

Based on the spending information presented in this report and the FAO’s most recent revenue forecast from the Spring 2021 Economic and Budget Outlook, the FAO has updated its 2020-21 budget deficit projection to $29.3 billion. In comparison, in the 2021 Ontario Budget, the Province projected a 2020-21 budget deficit of $38.5 billion. The difference between the FAO’s and the Province’s 2020-21 budget deficit projections is $9.2 billion.

Province

FAO

Difference

Revenue

151,813

154,479

2,666

Expense

Direct Spending:

Health

72,308

69,131

-3,177

Education

33,982

33,780

-202

Postsecondary Education

6,740

6,563

-177

Children’s and Social Services

18,033

17,737

-296

Justice

5,204

5,080

-124

Other Programs

36,790

33,424

-3,366

Interest on Debt

11,664

11,279

-385

Other Spending*

5,560

6,796

1,236

Total Expense

190,281

183,790

-6,491

Surplus/(Deficit)

(38,468)

(29,311)

9,157

Note: 2021 Budget is the Province’s 2020-21 interim budget deficit forecast in the 2021 Ontario Budget. FAO Projection is the FAO’s budget deficit forecast based on the FAO’s revenue forecast from the “Economic and Budget Outlook,” Spring 2021, the spending recorded in the Province’s Integrated Financial Information System (IFIS) as of April 22, 2021, and other estimated spending adjustments.

Source: 2021 Ontario Budget, FAO, “Economic and Budget Outlook,” Spring 2021, and information provided by Treasury Board Secretariat.

The FAO estimates that 2020-21 total revenue will be $2.7 billion higher than forecast by the Province in the 2021 budget, as the outlook for the Ontario economy has improved since the preparation of the 2021 budget.

In terms of spending, the FAO projection for total expense is $6.5 billion lower than the expense forecast in the 2021 budget. The difference in the two spending forecasts reflects the more up-to-date information available to the FAO (as of April 22, 2021) compared to the Province’s spending forecast in the 2021 budget.

Status of Unallocated Funds

The Province’s initial $165.2 billion spending plan for 2020-21 included $5.1 billion in unallocated funds through three programs: the COVID-19 Health Sector Response Fund (Health Fund), the Support for People and Jobs Fund (SPJF) and the Contingency Fund. In the second quarter, the Province added $10.7 billion in ‘top-ups’ to these three programs and in the fourth quarter the Province topped up the Contingency Fund by another $4.0 billion. Overall, the Province added $14.7 billion to the three unallocated funds during the year, bringing the total funds available to $19.8 billion.

The unallocated funds in the Health Fund, SPJF and Contingency Fund cannot be spent directly by the Province but must be transferred to government programs through Treasury Board Orders. The Province transferred $2.5 billion from the three unallocated funds to various programs in the first quarter, $1.6 billion in the second quarter, $7.1 billion in the third quarter and $5.2 billion in the fourth quarter. After accounting for these transfers, the remaining year-end balances in the Health Fund and SPJF were zero, while the remaining balance in the Contingency Fund was $3.4 billion.

Unallocated Fund

Opening Balance

Q2 Top-Ups

Q4 Top-Ups

Q1 Transfers

Q2 Transfers

Q3 Transfers

Q4 Transfers

Balance at Year-End

Health Fund

1,823

4,344

-

-1,505

-197

-4,237

-229

-

SPJF

1,966

3,000

-

-629

-1,301

-1,330

-1,706

-

Contingency Fund

1,300

3,394

3,988

-359

-54

-1,549

-3,285

3,436

Total

5,089

10,738

3,988

-2,493

-1,551

-7,115

-5,220

3,436

The following three tables provide information on transfers from the SPJF, Health Fund and Contingency Fund during the fourth quarter of 2020-21.[8]

Ministry/Program

$ millions

Ministry of Economic Development, Job Creation and Trade

Ontario Small Business Support Grant

1,559

Ministry of Energy, Northern Development and Mines

Energy Support, Engagement and Indigenous Partnership Programs

105

Ministry of Municipal Affairs and Housing

Homelessness Programs

42

Total Fourth Quarter Transfers

1,706

Ministry/Program

$ millions

Ministry of the Attorney General

Justice Centre – Community Partnerships

3

Victim Crisis Assistance Ontario

2

Supervised Access

2

Ministry of Children, Community and Social Services

Complex Special Needs

4

Child Protection Services

4

Supportive Services

1

Child Welfare – Community and Prevention Supports

1

Supports to Victims of Violence

1

Residential Services

< 1

Financial and Employment Supports

< 1

Supports to Individuals and Families (operating)

< 1

Ministry of Colleges and Universities

Grants for College Operating Costs

4

Grants for University Operating Costs

4

Ministry of Education

Priority and Partnerships Funding – Third Parties

7

Ministry of Government and Consumer Services

Ontario Shared Services

100

Ministry of Indigenous Affairs

Participation Fund

4

Ministry of Long-Term Care

Long-Term Care Homes – Operations

84

Ministry of Municipal Affairs and Housing

Homelessness Programs

2

Ministry of the Solicitor General

Correctional Services Operational Support

8

Total Fourth Quarter Transfers

229

Ministry/Program

$ millions

Ministry of Agriculture, Food and Rural Affairs

Agricultural Drainage Infrastructure Program

7

Ministry of the Attorney General

Agency and Tribunal Relations

32

Indigenous Healing and Wellness Strategy

2

Citizenship and Immigration Initiatives

2

Economic Empowerment Initiatives

2

Ontario Works – Financial Assistance

< 1

Child Welfare – Community and Prevention Supports

< 1

Youth Justice Services

< 1

Children's Activity Tax Credit

< 1

Ontario Disability Support Program – Employment Assistance

< 1

Ministry of Economic Development, Job Creation and Trade

Ontario Small Business Support Grant

1,841

Ontario Innovation Tax Credit

16

Regional Opportunities Investment Tax Credit

6

Business Research Institution Tax Credit

2

Ministry of Education

Priorities and Partnerships Funding – Third Parties

980

Childcare Access and Relief from Expenses Tax Credit

20

Ministry of Government and Consumer Services

Ontario Shared Services

307

Realty Transactions (Operating)

< 1

Ministry of Health

Healthy Homes Renovation Tax Credit

< 1

Ministry of Heritage, Sport, Tourism and Culture Industries

Ontario Computer Animation and Special Effects Tax Credit

25

Ontario Film and Television Tax Credit

24

Ontario Production Services Tax Credit

11

Sport

8

Grants in Support for Tourism Regions

6

Agencies and Attractions Sector Support

5

Ontario Trillium Foundation

4

Heritage Sector Support

2

Ontario Book Publishing Tax Credit

1

Ontario Sound Recording Tax Credit

< 1

Ministry of Indigenous Affairs

Land Claim Settlements

135

Indigenous Economic Development Fund

6

Ministry Administration Program

2

Ministry of Labour, Training and Skills Development

Employment and Training

181

Ontario Jobs Training Tax Credit

65

Ontario Co-operative Education Tax Credit

12

Ontario Apprenticeship Training Tax Credit

4

Ministry of Long-Term Care

Long-Term Care Homes – Operations

52

Ministry of Municipal Affairs and Housing

COVID-19 Recovery Funding for Municipalities

500

Homelessness Programs

255

Ministry of Natural Resources and Forestry

Public Protection

21

Ministry of Seniors and Accessibility

Seniors Affairs Transfer Payment

35

Seniors' Home Safety Tax Credit

10

Ministry of the Solicitor General

Other Programs

14

Ministry of Transportation

Municipal Transit

150

Net transfers to the Contingency Fund

-1,462

Net Total Fourth Quarter Transfers

3,285

About this Document

Established by the Financial Accountability Officer Act, 2013, the Financial Accountability Office (FAO) provides independent analysis on the state of the Province’s finances, trends in the provincial economy and related matters important to the Legislative Assembly of Ontario.

This report has been prepared with the benefit of publicly available information and information provided by Treasury Board Secretariat.

All dollar amounts are in Canadian, current dollars (i.e., not adjusted for inflation) unless otherwise noted.

Prepared by:

Michelle Gordon (Senior Financial Analyst), Jacob Kim (Financial Analyst) and Matthew Stephenson (Manager, Financial Analysis), under the direction of Luan Ngo (Director, Financial Analysis) and Jeffrey Novak (Chief Financial Analyst).

Graphic Descriptions

Year

Actual less planned spending

($ billions)

Actual less planned spending

(per cent)

2010-11

-4.9

-3.6%

2011-12

-2.5

-2.0%

2012-13

-2.2

-1.7%

2013-14

-3.4

-2.6%

2014-15

-3.1

-2.3%

2015-16

-5.2

-3.7%

2016-17

-4.5

-3.2%

2017-18

-2.0

-1.3%

2018-19

-7.3

-4.5%

2019-20

-3.2

-2.0%

2020-21

-10.3

-5.5%

Footnotes

[1] Excludes $9.1 billion in additional planned spending by the broader public sector organizations controlled by the Province (hospitals, school boards and colleges), the Province’s agencies and the legislative offices.

[2] For example, in 2019-20, there was a net spending increase of $323 million that was recorded between the year-end closing date and the release of the 2019-20 Public Accounts of Ontario. In the 2017-18 fiscal year, significant spending changes were recorded from July to September of 2018 that were reflected in the 2017-18 Public Accounts of Ontario. These changes included $713 million for an anticipated settlement agreement with physicians and $981 million for First Nations land claim settlements and anticipated settlements.

[3] This spending plan was formally tabled in the 2020-21 Expenditure Estimates. Excludes $9.1 billion in additional planned spending by the broader public sector organizations controlled by the Province (hospitals, school boards and colleges), the Province’s agencies and the legislative offices. The Province does not actively monitor or control this spending. Also excludes $3.6 billion in additional planned spending on capital assets and $1.2 billion on operating assets.

[4] 2020 Ontario Budget, p. 176.

[5] For analysis on the first three quarters of 2020-21, see FAO, “Expenditure Monitor 2020-21: Q3,” 2021; FAO, “Expenditure Monitor 2020-21: Q2,” 2020; and FAO, “Expenditure Monitor 2020-21: Q1,” 2020.

[6] For more information, see FAO, “Ministry of Health: Spending Plan Review,” 2021.

[7] For more information, see FAO, “Ministry of Education: Spending Plan Review,” 2021.

[8] For details on first quarter transfers see FAO, “Expenditure Monitor 2020-21: Q1,” 2020. For the second quarter, see FAO, “Expenditure Monitor 2020-21: Q2,” 2020. The second quarter transfer amount has been revised from the $1.3 billion stated in the FAO’s report based on updated information. An additional $241 million was transferred from the SPJF in the second quarter for the Canada Emergency Commercial Rent Assistance program. For the third quarter, see FAO, “Expenditure Monitor 2020-21: Q3,” 2021.