Cost, Recent Changes and the Impact on Electricity Bills

1 | Summary

- This report examines the Province’s nine energy and electricity subsidy programs, estimates the cost of the programs over 20 years, and reviews how the programs affect the electricity bills of Ontario households and businesses. The report also identifies changes to the subsidy programs since the introduction of the Fair Hydro Plan in 2017 and estimates the cost of those changes. Finally, the report discusses how the Province plans to achieve its commitment to lower electricity bills by 12 per cent.

Cost of the Energy and Electricity Subsidy

- The Province’s nine energy and electricity subsidy programs include seven programs that directly reduce the electricity bills of Ontario households and businesses, and two personal income tax credits, which provide payments to low- to moderate-income Ontario residents to assist with energy costs.

- Over the 20-year period from 2020-21 to 2039-40, the FAO estimates that the nine programs will cost the Province a total of $118.1 billion.[1]

- Two programs account for 71 per cent of the 20-year cost: the Ontario Electricity Rebate (OER) and the Renewable Cost Shift.[2] The OER will cost $45.4 billion (38.4 per cent) to provide Ontario households, small businesses, farms and long-term care homes with an on-bill rebate (averaged 19 per cent in 2021) that also limits the growth of residential electricity bills to two per cent annually. The Renewable Cost Shift will cost $38.6 billion (32.7 per cent) to move most of the cost of 33,000 renewable energy contracts with wind, solar and bioenergy generators from all electricity ratepayers to the Province.

- Three rural programs (Distribution Rate Protection Program (DRP), Rural or Remote Rate Protection Program (RRRP), and On-Reserve First Nations Delivery Credit) will cost $17.1 billion (14.5 per cent) to support rural and on-reserve households that face higher electricity distribution costs.

- Two tax credit programs – Ontario Energy and Property Tax Credit (OEPTC) – energy component and Northern Ontario Energy Credit (NOEC) – and the Ontario Electricity Support Program (OESP) will provide a combined $16.9 billion (14.3 per cent) in support to low- and moderate-income Ontario residents.

- The Northern Industrial Electricity Rate Program (NIERP) will cost $0.2 billion (0.2 per cent) to support large northern industrial ratepayers in 2020-21 and 2021-22, when the program is scheduled to expire.[3]

- The FAO estimates that the combined annual cost of the nine programs will reach $6.9 billion in 2021-22, but then gradually fall to $4.2 billion in 2039-40. This represents a $2.7 billion (40 per cent) decline from the cost of the programs in 2021-22.

- The projected 40 per cent decline in the annual cost of the nine programs is driven by $3.6 billion in expected lower spending for the Renewable Cost Shift, OER, OESP and NIERP programs, as these programs are either scheduled to expire (Renewable Cost Shift and NIERP) or are expected to cost less over time under current policy (OER and OESP).

- Those declines will be partially offset by higher spending of $0.9 billion for the three rural programs (DRP, RRRP and On-Reserve First Nations Delivery Credit) and the two tax credit programs (OEPTC – energy component and the NOEC), driven by expected increases in the number of eligible beneficiaries, benefit rates for the two tax credits that are automatically indexed to the rate of inflation, and growth in electricity distribution costs.

Program Changes since 2017

- Since the introduction of the Fair Hydro Plan (FHP) in 2017, the Province has made two important changes to its energy and electricity subsidy programs. These two changes will cost the Province $52.9 billion from 2020-21 to 2039-40, which represents 45 per cent of the total estimated $118.1 billion cost of the Province’s nine energy and electricity subsidy programs over the 20-year period.

- In 2019, the Province replaced the FHP with the Ontario Electricity Rebate (OER), which the FAO estimates will cost an incremental $37.6 billion from 2020-21 to 2039-40. The cost increase is due to two important policy changes under the OER: (i) the Province’s current policy is to hold annual electricity bill increases for residential ratepayers to two per cent indefinitely (compared to the four years at the rate of inflation commitment under the FHP); and (ii) ratepayers will no longer have to repay any funds borrowed to reduce electricity bills through either the OER or the FHP.

- In 2021, the Province introduced the Renewable Cost Shift. The FAO estimates that the net incremental cost to the Province from this new program will be $15.3 billion over the 20-year period.

Impact of the Electricity Subsidy Programs on a Typical Residential Electricity Bill

- Of the Province’s nine energy and electricity subsidy programs, six programs provide an on-bill subsidy to residential electricity ratepayers. The FAO estimates that these six programs will provide residential ratepayers with a benefit of $63.9 billion over 20 years, from 2020-21 to 2039-40.

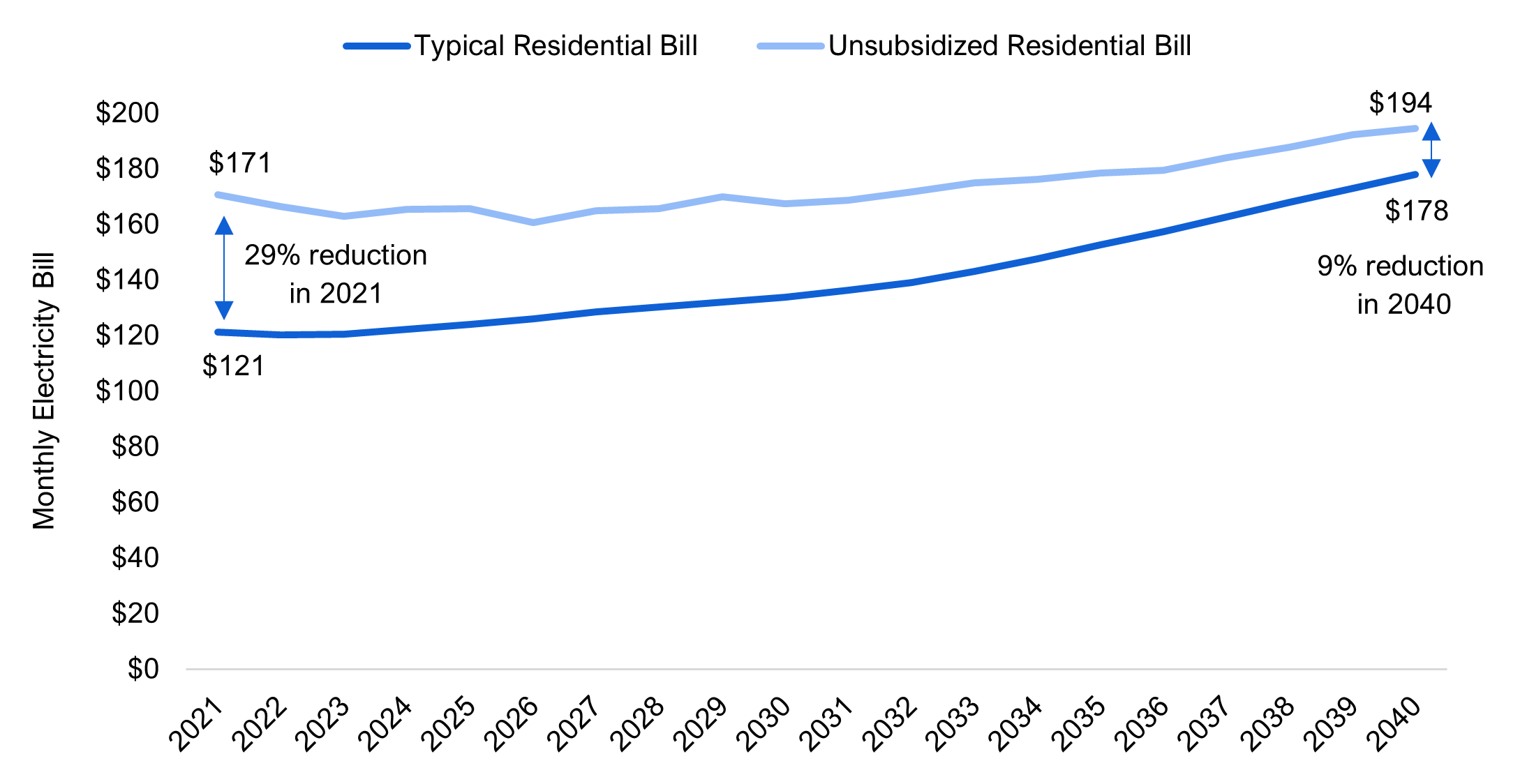

- The FAO estimates that a typical[4] residential ratepayer’s after-tax electricity bill was $121 per month in 2021. Without the Province’s on-bill electricity subsidy programs, the same after-tax electricity bill would have been $171 per month, meaning that the electricity subsidy programs reduced a typical residential ratepayer’s electricity bill by 29 per cent in 2021.

- Looking forward to 2040, the FAO estimates that a typical residential ratepayer electricity bill will increase by an annual average of two per cent from $121 per month in 2021 to $178 per month in 2040, due to government policy under the OER. On the other hand, the unsubsidized electricity bill for a typical residential ratepayer will increase by an annual average of only 0.7 per cent, from $171 per month in 2021 to $194 per month in 2040, due primarily to slow projected growth in the cost of generating electricity in Ontario. As a result, the after-tax electricity bill reduction provided by the Province’s electricity subsidy programs will decline to nine per cent by 2040.

The Commitment to Lower Electricity Bills by 12 Per Cent

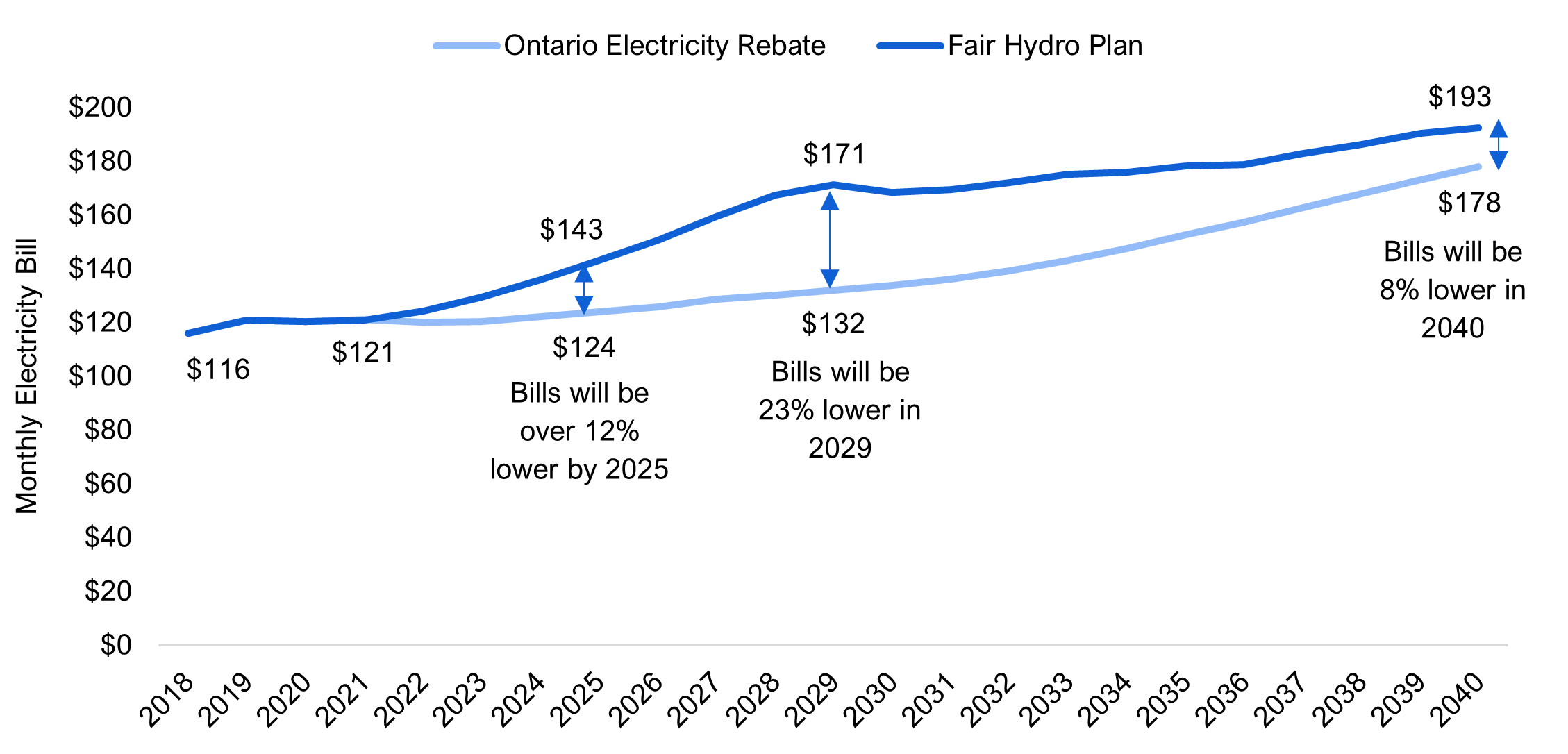

- The Province has committed to lower residential electricity bills by 12 per cent.[5] However, from 2018 to 2021, the FAO estimates that a typical residential ratepayer’s electricity bill increased by 4.3 per cent[6] and, looking forward, under current government policy, residential electricity bills will increase by two per cent on average each year through 2040.

- The FAO spoke with staff at the Ministry of Energy and was informed that the government does not intend to lower electricity bills by 12 per cent from 2018 levels. Instead, the government intends to meet its commitment to lower residential electricity bills by 12 per cent by comparing residential electricity bills under the current electricity subsidy programs against what electricity bills would have been under the electricity subsidy programs from 2017 (e.g., the Fair Hydro Plan).

- Through 2021, electricity bills under both scenarios are very similar, reaching $121 per month in 2021. However, beginning in 2022, electricity bills under the Fair Hydro Plan would have increased by approximately six per cent annually through 2028, while electricity bills under the current subsidy programs will increase by two per cent each year.[7] Consequently, the FAO estimates that, by 2025, a typical residential electricity bill under the current electricity subsidy programs will be over 12 per cent lower than what it would have been under the Fair Hydro Plan ($124 per month versus $143 per month).

Non-Residential Ratepayer Electricity Bills

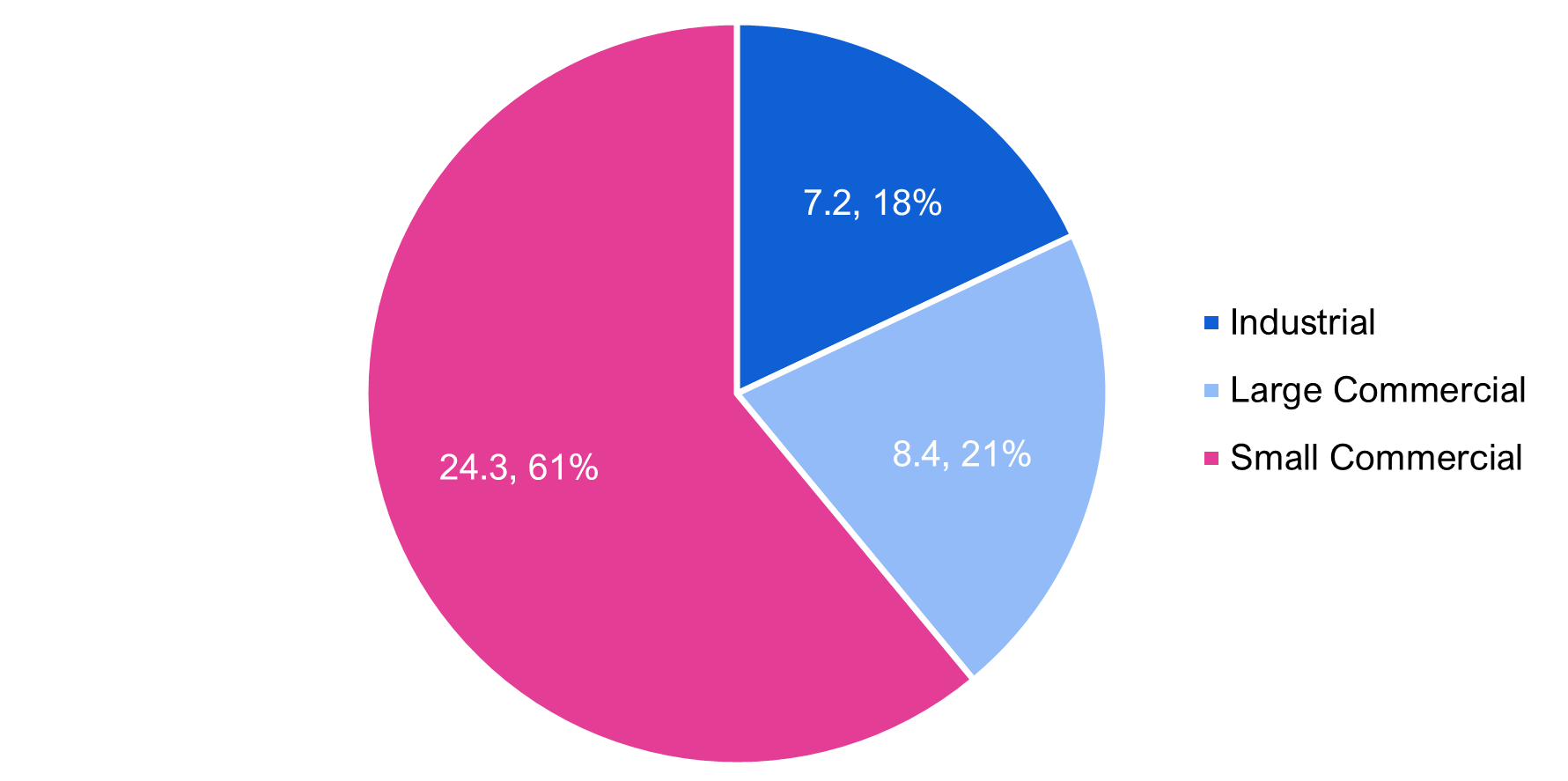

- Of the Province’s nine energy and electricity subsidy programs, three programs (Renewable Cost Shift, OER and NIERP) provide a subsidy to non-residential electricity ratepayers. The FAO estimates that over 20 years (from 2020-21 to 2039-40), approximately one-third ($39.8 billion) of provincial spending on energy and electricity subsidy programs will go towards reducing the electricity bills of non-residential ratepayers.

- $24.3 billon (61 per cent of the $39.8 billion 20-year total) will be provided to reduce electricity bills for non-residential ratepayers that are eligible for the OER (small businesses, farms and long-term care homes). These ratepayers will receive the same percentage rebate through the OER on their pre-tax electricity bill as residential ratepayers (19 per cent in 2021) and will also receive the same electricity price reduction from the Renewable Cost Shift.

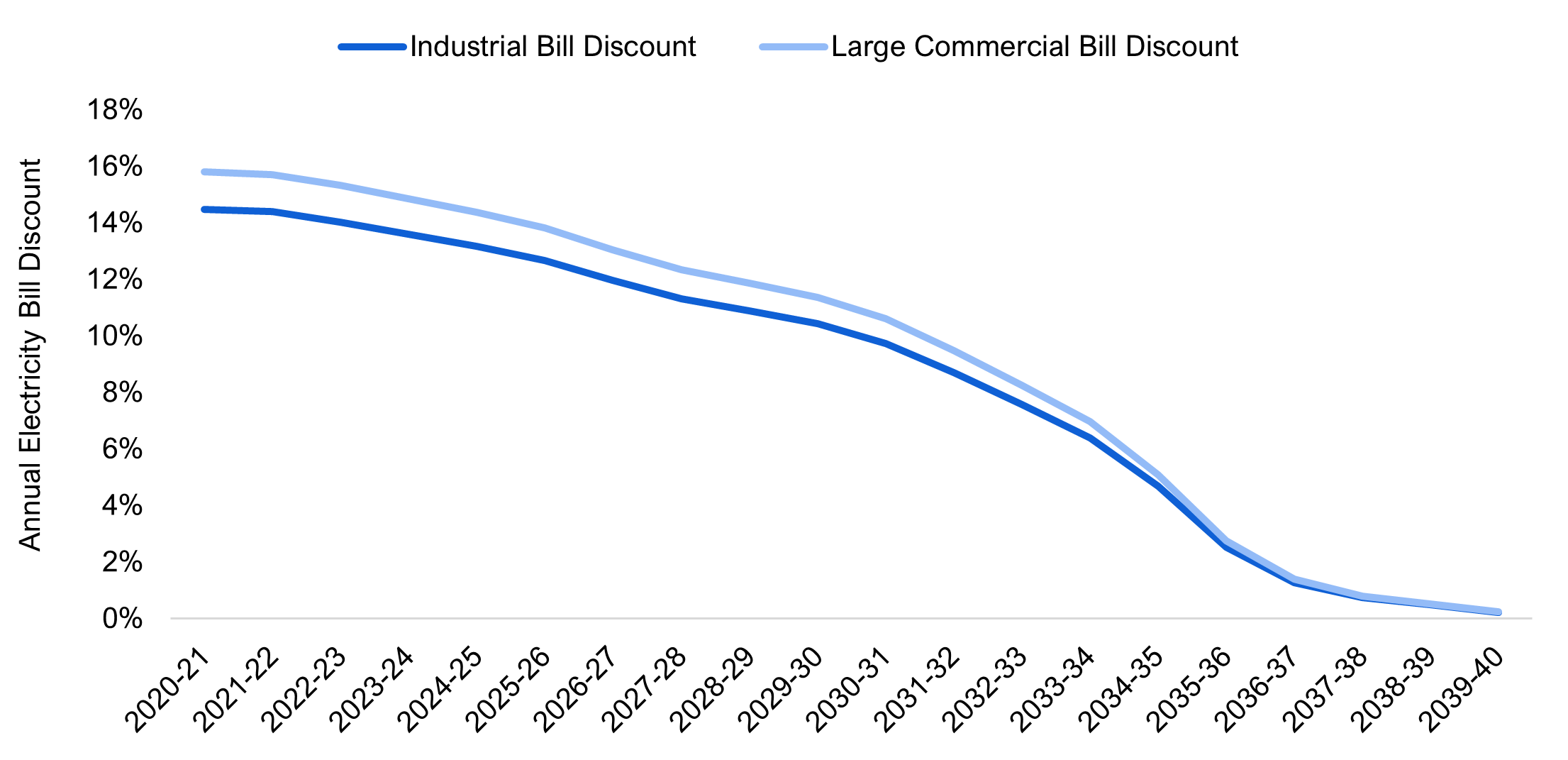

- $8.4 billion (21 per cent) will be provided to reduce electricity bills for large commercial ratepayers[8] through the Renewable Cost Shift. This results in a 16 per cent reduction to a typical large commercial ratepayer’s electricity bill in 2021-22. The discount will decline over time as the subsidized renewable energy contracts expire.

- $7.2 billion (18 per cent) will be provided to reduce electricity bills for industrial ratepayers.[9] Most of these payments ($6.9 billion) will be through the Renewable Cost Shift, which will provide a 14 per cent reduction to a typical industrial ratepayer’s electricity bill in 2021-22. This discount will decline over time as the subsidized renewable energy contracts expire. In addition, an estimated $0.2 billion will be provided to large[10] industrial ratepayers in Northern Ontario through the NIERP in 2020-21 and 2021-22. The NIERP provides a rebate of $20 per megawatt hour (up to $20 million per company), which represents a discount of approximately 22 per cent on the price of electricity for a typical industrial ratepayer in Ontario.

2 | Introduction

The Government of Ontario (the Province) funds a number of programs that subsidize the cost of energy and electricity for Ontario households and businesses. The government’s subsidy programs have experienced significant changes in the last five years, starting with the introduction of the Fair Hydro Plan in 2017. The Fair Hydro Plan committed to reduce residential electricity bills by 25 per cent and to hold electricity bill increases to the rate of inflation for four years.[11] Since 2017, the government has committed “to lower hydro [electricity] bills by 12 per cent,”[12] replaced the Fair Hydro Plan with the Ontario Electricity Rebate, and introduced the Renewable Cost Shift, a program that moves the cost of renewable energy contracts from electricity ratepayers to the Province.[13]

The purpose of this report is to review the Province’s energy and electricity subsidy programs. The report identifies the Province’s energy and electricity subsidy programs, explains how the programs work, and then provides a 20-year cost estimate for the programs from 2020-21 to 2039-40. Next, the report analyzes the major program changes that have occurred since the introduction of the Fair Hydro Plan in 2017 and estimates the cost of these changes to the Province. Finally, taking into account the Province’s current policy for its electricity subsidy programs, the report forecasts electricity bills for residential and non-residential ratepayers through 2040 and discusses how the Province plans to achieve its commitment to lower electricity bills by 12 per cent.

Excluded from this report is a review of the Province’s time-limited energy and electricity subsidy programs introduced in response to the COVID-19 pandemic. The FAO estimates that these programs will cost the Province a total of $850 million over three fiscal years, from 2019-20 to 2021-22.[14]

The Appendix provides more information on the development of this report, including the FAO’s methodology and sensitivity of results.

3 | Energy and Electricity Subsidy Programs

In 2021-22, the FAO estimates that the Province will spend approximately $6.9 billion through nine energy and electricity subsidy programs. This includes seven programs that directly reduce the electricity bills of Ontario households and businesses, and two personal income tax credits, which provide payments to low- to moderate-income Ontario residents to assist with energy costs. Table 1 and the following discussion provide additional details on each of the nine programs.

| Program | Eligibility | Benefit to Eligible Ratepayers or Residents in 2021-22 | Support in 2021-22 ($ millions) |

Share of Total Support |

|---|---|---|---|---|

| Renewable Cost Shift* | All ratepayers | Removes most of the cost of renewable energy contracts from ratepayer electricity bills | 3,122 | 45.2% |

| Ontario Electricity Rebate (OER) | Residential, small business, farm and long-term care home ratepayers | Rebate equal to 19 per cent of the pre-tax electricity bill | 2,363 | 34.2% |

| Ontario Energy and Property Tax Credit (OEPTC) – energy component | Low- to moderate-income Ontario residents who pay rent or property tax, or live in a long-term care home or on a reserve | Payment up to $243, delivered as part of the Ontario Trillium Benefit | 521 | 7.5% |

| Distribution Rate Protection Program (DRP) | Residential ratepayers who live in areas with higher distribution costs | $36.86 cap on the monthly base delivery charge | 325 | 4.7% |

| Rural or Remote Rate Protection Program (RRRP) | Residential ratepayers located in rural or remote areas | Reduces monthly delivery charge by $60.50 | 246 | 3.6% |

| Ontario Electricity Support Program (OESP) | Low- to moderate-income residential ratepayers | Monthly on-bill credit between $35 and $113 | 173 | 2.5% |

| Northern Industrial Electricity Rate Program (NIERP) | Large industrial ratepayers in Northern Ontario | Rebate of $20 per megawatt hour up to $20 million per company | 113 | 1.6% |

| Northern Ontario Energy Credit (NOEC) | Low- to moderate-income Northern Ontario residents who pay rent or property tax, or live in a long-term care home or on a reserve | Payment up to $243, delivered as part of the Ontario Trillium Benefit | 28 | 0.4% |

| On-Reserve First Nations Delivery Credit | On-reserve First Nations ratepayers | Removes the delivery charge for all on-reserve First Nations households | 24 | 0.4% |

| Total | 6,916 | 100% |

- Renewable Cost Shift[15] is a program (introduced in 2021) which shifts approximately 85 per cent of the cost of electricity generation from 33,000 renewable energy contracts with wind, solar and bioenergy generators, from ratepayers to the Province. In 2021-22, this program will provide $3.1 billion (45.2 per cent of total energy and electricity subsidy support), which will reduce the price of electricity generation for all ratepayers in Ontario by approximately 20 per cent.[16]

- Ontario Electricity Rebate (OER) provides an on-bill rebate to Ontario households, small businesses, farms and long-term care homes, which averaged 19 per cent of pre-tax electricity bills in 2021.[17] This program was introduced in November 2019, and the rebate percentage is set each year to limit the increase in residential electricity bills to two per cent. In 2021-22, the FAO estimates the OER will provide a total of $2.4 billion (34.2 per cent of total energy and electricity subsidy support).

- Ontario Energy and Property Tax Credit (OEPTC) – Energy Component provides payments up to $243 to eligible low- to moderate-income Ontario residents[18] to assist with the sales tax on home energy spending. In 2021-22, the FAO estimates that the energy component of the OEPTC will provide $521 million (7.5 per cent of total energy and electricity subsidy support).

- Distribution Rate Protection (DRP) was introduced in 2017 to reduce the cost of delivering electricity for households in areas with high electricity distribution costs by capping the monthly base delivery charge. In 2021-22, the DRP will provide $325 million (4.7 per cent of total energy and electricity subsidy support).

- Rural or Remote Rate Protection (RRRP) reduces the monthly delivery charge for households in rural or remote areas of Ontario by $60.50. In 2021-22, the RRRP will provide $246 million (3.6 per cent of total energy and electricity subsidy support).

- Ontario Electricity Support Program (OESP) provides a direct on-bill credit ranging from $35 to $113 per month for eligible low-income households in Ontario. The credit amount depends on household income and the number of people in the household. In 2021-22, the FAO estimates that the OESP will provide $173 million (2.5 per cent of total energy and electricity subsidy support).

- Northern Industrial Electricity Rate Program (NIERP) provides a rebate of $20 per megawatt hour to large[19] industrial ratepayers in Northern Ontario with a maximum rebate of $20 million per company. In 2021-22, the FAO estimates that the NIERP will provide approximately $113 million (1.6 per cent of total energy and electricity subsidy support).

- Northern Ontario Energy Credit (NOEC) provides payments up to $243 to eligible low- to moderate-income residents[20] in Northern Ontario to assist them with higher home energy costs. In 2021-22, the FAO estimates the NOEC will provide $28 million (0.4 per cent of total energy and electricity subsidy support).

- On-Reserve First Nations Delivery Credit removes the electricity delivery charge for all on-reserve First Nations households. In 2021-22, the FAO estimates that the On-Reserve First Nations Delivery Credit will provide $24 million (0.4 per cent of total energy and electricity subsidy support).

4 | Cost of the Programs from 2020-21 to 2039-40

In total, the FAO estimates that the nine energy and electricity subsidy programs will cost the Province $118.1 billion[21] over the 20-year period from 2020-21 to 2039-40. Two programs account for 71 per cent of the 20-year cost: the OER, which will cost $45.4 billion (38.4 per cent), and the Renewable Cost Shift, which will cost $38.6 billion (32.7 per cent). The three rural programs (DRP, RRRP and the On-Reserve First Nations Delivery Credit) will provide a combined $17.1 billion (14.5 per cent) in support to rural and on-reserve households. The two tax credits (OEPTC and NOEC) and the OESP will provide a combined $16.9 billion (14.3 per cent) in support to low- and moderate-income families. Finally, the NIERP is expected to cost $0.2 billion (0.2 per cent) to support large northern industrial ratepayers.

| Program | Cost from 2020-21 to 2039-40 ($ billions) |

Share of Total Cost | |

| Ontario Electricity Rebate (OER) | 45.4 | 38.4% | |

| Renewable Cost Shift | 38.6 | 32.7% | |

| Ontario Energy and Property Tax Credit (OEPTC) – energy component | 13.7 | 11.6% | |

| Distribution Rate Protection Program (DRP) | 10.4 | 8.8% | |

| Rural or Remote Rate Protection Program (RRRP) | 6.1 | 5.2% | |

| Ontario Electricity Support Program (OESP) | 2.5 | 2.1% | |

| Northern Ontario Energy Credit (NOEC) | 0.7 | 0.6% | |

| On-Reserve First Nations Delivery Credit | 0.6 | 0.5% | |

| Northern Industrial Electricity Rate Program (NIERP) | 0.2 | 0.2% | |

| Total | 118.1 | 100% | |

The FAO estimates that the combined annual cost of the nine programs will rise from $6.1 billion in 2020-21 to $6.9 billion in 2021-22. Combined spending on the programs will stay at approximately this level for four years, until 2024-25, and then gradually decline to $4.2 billion in 2039-40, a $2.7 billion (40 per cent) decline from the cost of the programs in 2021-22.

Figure 1: Estimated cost of Ontario’s nine energy and electricity subsidy programs by year from 2020-21 to 2039-40, $ billions

Notes: The “OER” is the Ontario Electricity Rebate program; the “Rural Programs” consists of the Distribution Rate Protection Program, the Rural or Remote Rate Protection Program and the On-Reserve First Nations Delivery Credit; “Tax Credits” consists of the Ontario Energy and Property Tax Credit – energy component and the Northern Ontario Energy Credit; the “OESP” is the Ontario Electricity Support Program; and the “NIERP” is the Northern Industrial Electricity Rate Program.

Source: FAO analysis of information provided by the Ministry of Energy and the Independent Electricity System Operator, and publicly available information.

The $0.8 billion projected increase in the combined annual cost of the nine programs from 2020-21 to 2021-22 is due to the introduction of the Renewable Cost Shift in January 2021. From 2021-22 to 2039-40, the estimated $2.7 billion net decline in the annual cost of the nine programs is driven by $3.6 billion in expected lower spending for the Renewable Cost Shift, OER, OESP and NIERP programs. The lower spending in those programs will be partially offset by higher spending of $0.9 billion for the three rural programs (DRP, RRRP and On-Reserve First Nations Delivery Credit) and the two tax credit programs (OEPTC – energy component and the NOEC).

Renewable Cost Shift and the Ontario Electricity Rebate

The FAO estimates that Renewable Cost Shift spending will peak in 2022-23 at $3.1 billion and then gradually decline over time until the program expires at the end of 2040. The Renewable Cost Shift subsidizes the cost of over 33,000 renewable energy contracts with wind, solar and bioenergy generators, most of which are 20-year contracts entered into between 2009 and 2016. Over time, the cost of the program will decline as the contracts expire, largely beginning in 2028 until the last contract expires around 2040.

The FAO projects that the cost of the OER will decline from $2.4 billion in 2021-22 to $2.0 billion in 2039-40. Under the OER, the Province’s current policy is to set the rebate percentage so that the electricity bill for a typical residential ratepayer increases by two per cent each year. However, from 2021 to 2040, the FAO estimates that the cost to supply a typical household with electricity will increase by an annual average of only 0.7 per cent. Consequently, the cost to ensure that residential electricity bills increase by two per cent each year (i.e., the cost of the OER) will decline over time because the percentage of the pre-tax electricity bill that the Province will be required to subsidize will also decline.[22] In other words, due to the commitment to ensure that residential electricity bills increase by two per cent each year, electricity bills will grow at a faster rate than the supply cost of electricity from 2020-21 to 2039-40. This results in the projected decline in the cost of the OER over this time period.

Ontario Electricity Support Program

The FAO projects that annual OESP spending will decline by $99 million from $181 million in 2020-21 to $82 million in 2039-40, primarily because the OESP credit amounts, and the income brackets that determine eligibility, are not automatically indexed to grow by the rate of inflation.[23] Changes to the credit amounts and income brackets can be made through regulation, which the Province has done only once (in 2017) since the creation of the program in 2015. Consequently, the FAO has assumed no change to the credit amounts or income brackets over the 20-year review period. If the Province does change the credit amounts or income brackets, then the cost of the OESP will increase.

Northern Industrial Electricity Rate Program

The FAO projects that the annual cost of the NIERP will increase by $6 million from $107 million in 2020-21 to $113 million in 2021-22, after which the current phase of the NIERP is set to expire. Given that the Province has not yet announced an extension of the program, the FAO cost projection assumes that the program ends on March 31, 2022. If the Province decides to extend the NIERP, then the total cost of the energy and electricity subsidy programs would increase by approximately $120 million for each year of the extension (assuming the program parameters remain the same).

Rural Programs

The FAO projects that the annual cost of the three rural programs (DRP, RRRP and the On-Reserve First Nations Delivery Credit) will increase by $551 million from $572 million in 2020-21 to $1,123 million in 2039-40. The increase in the projected cost of the programs is driven by expected increases in the number of eligible customers and growth in the cost of distributing electricity to those customers.

Tax Credits

For the two tax credit programs, the energy component of the OEPTC and the NOEC, the credit amount and the income thresholds are automatically indexed to grow at the rate of inflation. The growth in support provided through the two tax credit programs is therefore driven by the number of eligible Ontario residents, the rate of inflation and income growth. Between 2020-21 and 2039-40, the FAO projects that the annual costs of the energy component of the OEPTC and the NOEC will grow, on average, by 2.8 per cent and 2.3 per cent, respectively, with total spending increasing by $355 million from $525 million in 2020-21 to $881 million in 2039-40.

5 | Program Changes since 2017

Since the introduction of the Fair Hydro Plan in 2017, the Province has made two main changes to its energy and electricity subsidy programs:

- in 2019, the Province replaced the Fair Hydro Plan with the Ontario Electricity Rebate (OER); and

- in 2021, the Province introduced the Renewable Cost Shift.

The FAO estimates that these two changes will cost the Province a total of $52.9 billion[24] over 20 years, from 2020-21 to 2039-40.[25] Incremental spending due to these two program changes represents 45 per cent of the total estimated $118.1 billion cost of the Province’s nine energy and electricity subsidy programs from 2020-21 to 2039-40. In other words, the two program changes are expected to nearly double the cost of the Province’s energy and electricity subsidy programs over 20 years.

Replacing the Fair Hydro Plan with the Ontario Electricity Rebate

In 2017, the Province introduced the Fair Hydro Plan (FHP). Under the FHP, the Province reduced residential electricity bills by an average of 25 per cent and committed to limit the increase in electricity bills to the rate of inflation over four years. The FHP was comprised of three initiatives:

- The cost of funding the RRRP and OESP was removed from electricity bills and was funded by the Province.

- The Province provided a rebate equal to the provincial portion of the HST (eight per cent) on residential, small business and farm electricity bills (the HST rebate).

- Electricity Cost Refinancing: the Province (and its related entities) borrowed funds to pay a portion of the cost of electricity generation for eligible ratepayers. The debt used to finance the electricity cost reduction was to accumulate over time and then be repaid by electricity ratepayers through additional charges on their electricity bills.

In 2019, the Province replaced the HST rebate and electricity cost refinancing components of the FHP with the Ontario Electricity Rebate (OER).[26] Starting in November 2019, the OER combined these two components of the FHP into one on-bill rebate for residential, small business and farm ratepayers, which effectively provided the same electricity cost reduction that these ratepayers received under the FHP.

Importantly, the introduction of the OER included two significant policy changes:

- Under the OER, the Province’s current policy is to hold annual electricity bill increases for residential ratepayers to two per cent indefinitely (compared to the four years at the rate of inflation commitment under the FHP).[27]

- Ratepayers will no longer have to repay any funds borrowed to reduce electricity bills under either the OER or the electricity cost refinancing component of the FHP, through additional charges on their electricity bills.

The FAO estimates that these two policy changes included as part of the OER will cost the Province $37.6 billion over 20 years, from 2020-21 to 2039-40.

Introducing the Renewable Cost Shift[28]

As noted above, the Renewable Cost Shift moves approximately 85 per cent of the cost of electricity generation from 33,000 renewable energy contracts with wind, solar and bioenergy generators, from ratepayers to the Province. The FAO estimates that the new program will cost $38.6 billion over 20 years, from 2020-21 to 2039-40. However, as noted previously, when the Province introduced the Renewable Cost Shift, the Province also lowered the rebate provided to residential, small business and farm ratepayers through the OER so that these ratepayers would have no net change to their electricity bills. This means that only large commercial and industrial ratepayers that are not eligible for the OER received a net reduction in their electricity costs through the Renewable Cost Shift. Consequently, the incremental cost of the Renewable Cost Shift, after accounting for the reduction in the OER discount, is projected to be $15.3 billion over 20 years, from 2020-21 to 2039-40.

6 | Residential Ratepayer Electricity Bills

Of the Province’s nine energy and electricity subsidy programs, six programs provide an on-bill subsidy to residential electricity ratepayers. The FAO estimates that these six programs will provide residential ratepayers with a benefit of $63.9 billion over 20 years, from 2020-21 to 2039-40. This chapter reviews the FAO’s forecast for a typical residential ratepayer electricity bill after accounting for the Province’s on-bill electricity subsidy programs. In addition, the FAO reviews the Province’s commitment to lower electricity bills by 12 per cent.

Impact of the Electricity Subsidy Programs on a Typical Residential Electricity Bill

The FAO estimates that a typical residential after-tax electricity bill[29] was $121 per month in 2021. Without the Province’s on-bill electricity subsidy programs, a typical residential after-tax electricity bill in 2021 would have been $171 per month, meaning that the electricity subsidy programs reduced a typical residential ratepayer’s electricity bill by 29 per cent in 2021.

Figure 2: Estimated monthly typical residential electricity bill with and without provincial electricity subsidy programs, 2021 to 2040, $

Note: A “typical residential ratepayer” is a residential customer paying time-of-use electricity pricing with average monthly household electricity intensity. This ratepayer is not a rural or low-income ratepayer and so is ineligible for the Ontario Electricity Support Program, the Distribution Rate Protection Program, the Rural or Remote Rate Protection Program and the On-Reserve First Nations Delivery Credit.

Source: FAO analysis of information provided by the Ministry of Energy and the Independent Electricity System Operator, and publicly available information.

Looking forward to 2040, the FAO estimates that the after-tax electricity bill reduction provided by the Province’s electricity subsidy programs will gradually decline from 29 per cent in 2021 to nine per cent in 2040. This decline is due primarily to the FAO’s projection that the two per cent growth in residential electricity bills provided for under the OER will outpace the growth in the cost to supply residential ratepayers with electricity. This means that the proportion of residential bills that the Province will need to subsidize to limit after-tax electricity bill growth to two per cent annually will gradually decline.

Over the forecast period, the FAO estimates that a typical residential after-tax electricity bill will increase at an average annual rate of 2.0 per cent from $121 per month in 2021 to $178 per month in 2040. This is largely the result of the current policy commitment under the OER to increase residential electricity bills by two per cent each year.[30]

On the other hand, the FAO projects that the unsubsidized electricity bill for a typical residential ratepayer will increase by an annual average rate of only 0.7 per cent, from $171 per month in 2021 to $194 per month in 2040. This unsubsidized electricity bill represents the after-tax cost to supply residential ratepayers with electricity and is what ratepayers would pay if there were no provincial electricity subsidy programs. The slow growth in the unsubsidized electricity bill is due primarily to slow projected growth in the cost of generating electricity in Ontario.[31]

The Commitment to Lower Electricity Bills by 12 Per Cent

The Province has committed to lower electricity bills by 12 per cent.[32] As noted in the previous section, under the government’s current electricity subsidy programs, the FAO projects that a typical residential after-tax electricity bill will increase at an average annual rate of 2.0 per cent, from $121 per month in 2021 to $178 per month in 2040. Furthermore, from 2018 to 2021, the typical residential after-tax electricity bill also increased, by 4.3 per cent, from $116 per month in 2018 to $121 per month in 2021.

The FAO spoke with staff at the Ministry of Energy and was informed that the government does not intend to lower electricity bills by 12 per cent from 2018 levels. Instead, the government intends to meet its commitment to lower residential electricity bills by 12 per cent by comparing residential electricity bills under the current electricity subsidy programs (e.g., the Ontario Electricity Rebate and the Renewable Cost Shift) against what electricity bills would have been under electricity subsidy programs from 2017 (e.g., the Fair Hydro Plan). Under this approach, ministry staff informed the FAO that the Province’s commitment to lower residential electricity bills by 12 per cent is expected to be met in 2023.

To confirm the ministry’s statement, the FAO compared its projection for a typical residential ratepayer’s after-tax electricity bill under the current electricity subsidy programs against an estimate of what the electricity bill would have been under the FHP. Through 2021, electricity bills under both scenarios are very similar, reaching $121 per month in 2021.

However, beginning in 2022, electricity bills under the FHP would have increased by approximately six per cent annually through 2028. This is because electricity bill increases under the FHP were only to be held to inflation for four years, after which the subsidies under the electricity cost refinancing component of the FHP were to gradually expire and ratepayers would begin to repay the borrowed funds through additional charges on their electricity bills.

As noted above, the Province’s current policy through the OER is to limit annual electricity bill increases to two per cent and that ratepayers will no longer have to repay any of the borrowing required to subsidize their electricity bills under either the current electricity subsidy programs or the electricity cost refinancing component of the FHP (while the FHP was in operation). This results in a material difference, starting in 2022, between what a typical residential electricity bill would have been under the FHP compared to the projected typical residential electricity bill under the current electricity subsidy programs. This difference will continue to grow so that by 2025, the FAO estimates that a typical residential electricity bill under the current electricity subsidy programs will be over 12 per cent lower than what it would have been under the Fair Hydro Plan ($124 per month versus $143 per month).[33]

Figure 3: Monthly typical residential ratepayer electricity bills, Fair Hydro Plan vs. Ontario Electricity Rebate, 2018 to 2040, $

Note: A “typical residential ratepayer” is a residential customer paying time-of-use electricity pricing with average monthly household electricity intensity. This ratepayer is not a rural or low-income ratepayer and so is ineligible for the Ontario Electricity Support Program, the Distribution Rate Protection Program, the Rural or Remote Rate Protection Program and the On-Reserve First Nations Delivery Credit. "Fair Hydro Plan” represents projected after-tax electricity bills under the Province’s electricity subsidy programs from 2017. “Ontario Electricity Rebate” represents after-tax electricity bills under the Province’s current electricity subsidy programs.

Source: FAO analysis of information provided by the Ministry of Energy and the Independent Electricity System Operator, and publicly available information.

Beyond 2025, the FAO projects that the difference between the two scenarios will continue to increase until 2029, when a typical residential ratepayer’s electricity bill will be 23 per cent lower under the current electricity subsidy programs compared to what a typical residential ratepayer’s electricity bill would have been under the Fair Hydro Plan. After 2029, the difference between the two scenarios will begin to gradually decrease, so that by 2040, the FAO estimates that a typical residential ratepayer’s electricity bill will be eight per cent lower under the current electricity subsidy programs compared to the same electricity bill under the Fair Hydro Plan.

7 | Non-Residential Ratepayer Electricity Bills

Of the Province’s nine energy and electricity subsidy programs, three programs (Renewable Cost Shift, OER and NIERP) provide a subsidy to non-residential electricity ratepayers. The FAO estimates that over 20 years (from 2020-21 to 2039-40), approximately one-third ($39.8 billion) of provincial spending on its energy and electricity subsidy programs will go towards reducing the electricity bills of non-residential ratepayers. These benefits are allocated differently across three classes of non-residential ratepayers based on eligibility for the three different programs.

- The FAO estimates that $24.3 billon (61 per cent of the $39.8 billion 20-year total) will be provided to reduce electricity bills for non-residential ratepayers that are eligible for the OER. This includes small businesses, farms and long-term care homes.[34] All of these payments will be from the OER and Renewable Cost Shift.

- The FAO estimates that $8.4 billion (21 per cent) will be provided to reduce electricity bills for large commercial ratepayers. These are Class B ratepayers as defined by the IESO that are not eligible for the OER. All of these payments will be provided through the Renewable Cost Shift.

- The FAO estimates that $7.2 billion (18 per cent) will be provided to reduce electricity bills for industrial ratepayers. These are defined as Class A ratepayers by the IESO. The majority of these payments ($6.9 billion) will be through the Renewable Cost Shift, while an estimated $0.2 billion will be provided to large[35] industrial ratepayers in Northern Ontario through the NIERP.

Figure 4: Allocation of non-residential electricity subsidies by customer class, 2020-21 to 2039-40, $ billions

Note: “Small Commercial” includes small businesses, farms and long-term care homes; “Large Commercial” are Class B ratepayers as defined by the IESO that are not eligible for the Ontario Electricity Rebate; and “Industrial” are Class A ratepayers as defined by the IESO.

Source: FAO analysis of information provided by the Ministry of Energy and the Independent Electricity System Operator, and publicly available information.

For OER-eligible non-residential ratepayers (small businesses, farms and long-term care homes), the impact of the Province’s electricity subsidy programs on their electricity bills will be similar to the impact on residential electricity bills discussed in the previous section. These customers receive the same percentage rebate through the OER on their pre-tax electricity bill amount as residential customers. These customers will also receive the same electricity price reduction from the Renewable Cost Shift.

For large commercial and industrial ratepayers, the vast majority of subsidies will be provided through the Renewable Cost Shift. In a previous report, the FAO estimated that in 2021-22, the Renewable Cost Shift will provide a 14 per cent reduction to a typical industrial ratepayer’s electricity bill and a 16 per cent reduction to a typical large commercial ratepayer’s electricity bill.[36] The annual electricity bill reduction will decline over time as the renewable energy contracts subsidized by the program expire.

Figure 5: Annual electricity bill discount to large commercial and industrial ratepayers from the Renewable Cost Shift, 2020-21 to 2039-40

Note: The Renewable Cost Shift started on January 1, 2021. Electricity bill discounts in 2020-21 only apply to the three-month period starting January 1, 2021. “Large Commercial” are Class B ratepayers as defined by the IESO that are not eligible for the Ontario Electricity Rebate; “Industrial” are Class A ratepayers as defined by the IESO.

Source: FAO.

Finally, the NIERP provides eligible large industrial ratepayers in Northern Ontario with a rebate of $20 per megawatt hour (up to $20 million per ratepayer), which represents a discount of approximately 22 per cent on the price of electricity for a typical industrial ratepayer in Ontario.

8 | Appendix: Development of this Report

Authority

The Financial Accountability Officer accepted a request from a member of the Legislative Assembly to undertake the analysis presented in this report under paragraph 10(1)(b) of the Financial Accountability Officer Act, 2013.

Key Questions

The following key questions were used as a guide while undertaking research for this report:

- What are the Province’s energy and electricity subsidy programs?

- How much does the Province spend on the programs?

- What ratepayers benefit from the electricity subsidy programs?

- What are the future costs of the Province’s energy and electricity subsidy programs?

- What is the Province’s long-term policy for the programs?

- What will be the annual cost of the programs through 2040?

- How are the costs of the programs allocated between ratepayers and taxpayers?

- How will the cost of programs be financed?

- How have the costs of the Province’s programs changed since 2017?

- How do the Province’s electricity subsidy programs affect electricity bills?

- How will the Province’s electricity subsidy programs affect electricity bills through 2040?

- How are the subsidies allocated among different classes of ratepayers?

- How have changes to the Province’s electricity subsidy programs since 2017 affected ratepayer bills?

- How will the Province’s electricity subsidy programs affect electricity bills through 2040?

Methodology

This report has been prepared with the benefit of information provided by the Ministry of Energy and the Independent Electricity System Operator (IESO), and publicly available information. Specific sources are referenced throughout, and additional information on sources and methodology is available on request.

All dollar amounts are in Canadian, current dollars (i.e., not adjusted for inflation) unless otherwise noted.

The FAO’s projections for the future cost of the Province’s electricity subsidy programs are based on a 20-year model of the Ontario electricity sector developed by the FAO to estimate the future cost to supply electricity (i.e., the unsubsidized cost) to different classes of electricity ratepayers. This supply cost model was used to estimate the cost of the Renewable Cost Shift and the Ontario Electricity Rebate (OER), as well as the impact of those programs on eligible ratepayer bills. The model was also used to estimate typical ratepayer bills through 2040.

The FAO’s model focused primarily on estimating the cost to supply ratepayers eligible for the OER with electricity. The FAO model groups these ratepayers into three categories: residential ratepayers, non-residential ratepayers that pay prices set under the regulated price plan, and other OER-eligible Class B customers. The FAO then estimated the cost to supply each category of ratepayer based on the 2020 cost adjusted for projected future changes in the price of electricity, the cost of delivering electricity, regulatory charges, and electricity demand.

To estimate the unsubsidized price of electricity for residential ratepayers, the FAO used actual time-of-use prices set under the regulated price plan through October 31, 2022, adjusting for the impact of the Renewable Cost Shift. Beyond 2022, the FAO grew the electricity price based on the growth in the Class B price forecast provided to the FAO by the IESO. The FAO also adjusted residential consumption based on the IESO’s 2021 Annual Planning Outlook and the FAO’s projection of household growth.[37]

For the delivery and regulatory component costs, the FAO estimated future distribution charges by growing the 2020 cost based on rates approved by the Ontario Energy Board (OEB) through 2021, then by the FAO’s projected rate of inflation adjusted for changes in residential electricity demand. For transmission and regulatory charges, the FAO grew the 2021 cost by the rate of inflation and adjusted for changes in residential demand.

Once the cost to supply residential ratepayers through 2040 was estimated based on the parameters outlined above, the FAO then adjusted that cost to account for the impact of the Renewable Cost Shift and the OER. First, the cost of electricity generation was adjusted to account for the impact of the Renewable Cost Shift. The impact of the Renewable Cost Shift was estimated based on the Ministry of Energy’s estimate for the total amount of contract costs subsidized by the program in each year multiplied by the FAO’s projection of the share of Global Adjustment charges paid by residential ratepayers.

To determine the percentage rebate from the OER in each year, the FAO modelled an OER “proxy customer” in each year though 2040. This proxy customer is a customer with 700 kWh of monthly demand and who possesses the same characteristics as the proxy customer last outlined by the OEB in calculating the Fair Hydro Plan Global Adjustment Modifier in 2019.[38] The FAO then determined the percentage rebate required to limit growth in that proxy customer’s bill to two per cent through 2040. That percentage rebate is then applied to the total before-tax cost for all residential ratepayers to determine the portion of the total cost of the OER that goes to residential ratepayers.

The typical residential ratepayer electricity bill was then calculated based on the total cost of each component (electricity, delivery and regulatory charges) divided by the number of residential ratepayers. The electricity bill was then reduced by the OER rebate.

The rest of the cost of the OER was determined by applying the OER percentage rebate to the before-tax cost to non-residential OER-eligible customers. The Ministry of Energy estimates 71.6 TWh of Ontario demand was eligible for the OER in 2020. The FAO model first allocates approximately 49 TWh to residential demand, then 13 TWh to non-residential demand that pays electricity prices under the Regulated Price Plan (RPP); the final 10 TWh is then assumed to be other Class B demand.

The OER-eligible customers comprising the 13 TWh that pay RPP prices are assumed to be the General Service <50kW customers reported in the OEB’s 2020 electricity distributor yearbook.[39] The supply cost for those customers is estimated using RPP prices, demand and distributor costs reported by the OEB and retail transmission and regulatory rates. The going-forward cost of electricity is escalated in the same way as residential customers; however, demand is adjusted based on the IESO’s projection of commercial demand. For the remaining OER-eligible customers, the FAO estimated the cost to supply these customers based on the IESO’s forecast prices for Class B customers with demand escalated by the IESO’s forecast for commercial demand. The price of electricity is also adjusted for both classes of customers based on the FAO’s projected price reduction from the Renewable Cost Shift, which is calculated based on the amount of contract costs the program subsidizes each year multiplied by the FAO’s projection of the share of the Global Adjustment paid by each ratepayer category.

The cost of the OER was then determined in each year by applying the OER rebate percentage to the total pre-tax cost to all OER-eligible customers.

To project the cost for the energy component of the Ontario Energy and Property Tax Credit (OEPTC), the FAO broke down the OEPTC into several components and projected each component separately. The FAO estimated the total energy component before clawback using Statistics Canada’s Social Policy Simulation Database and Model (SPSDM) and grew the cost by inflation and projected population growth. The clawback rate, which is two per cent of net family income in excess of threshold income, is projected based on the FAO’s projection of income growth and inflation. The cost of the Northern Ontario Energy Credit (NOEC) is projected based on inflation and population growth in Northern Ontario.

Sensitivity and Uncertainty

The projected costs of the electricity subsidy programs presented in this report are based on forecasts of the future cost of electricity and electricity demand in Ontario. Those forecasts are subject to uncertainty, and this section will present the FAO’s estimate of how changes to certain key assumptions would affect the estimated future cost of the electricity subsidy programs.

Changes to the forecast cost and price of electricity generation would have the most significant impact on the cost of the electricity subsidy programs. This is because electricity generation is the largest component of ratepayer bills and has the most significant effect on the cost of the OER. Increases in the cost of electricity generation would significantly increase the cost of the OER because the Province would be required to subsidize a higher percentage of ratepayer bills to limit bill growth to two per cent annually.

As stated above, the FAO’s estimate for the future cost of electricity generation for OER-eligible customers is based on the IESO’s forecast for the cost to supply Class B ratepayers through 2040. This results in a projected negative average annual growth rate of 0.2 per cent for the price of electricity generation for residential ratepayers from 2022 to 2040. This growth rate is significantly below the historical average annual growth rate of 5.5 per cent from 2006 to 2020, which suggests a risk that growth in the cost of electricity generation could be higher than the rate used in the FAO’s projection.

The FAO estimates that a one-percentage point increase to the average annual growth rate of the cost of electricity generation from 2022 to 2040 (from -0.2 per cent to 0.8 per cent) would increase the cost of the OER by $18.8 billion over the 20-year time period, from $45.4 billion to $64.2 billion, while a two-percentage point increase (from -0.2 per cent to 1.8 per cent) would increase the cost of the OER by $41.7 billion, from $45.4 billion to $87.1 billion.

About this Document

Established by the Financial Accountability Officer Act, 2013, the Financial Accountability Office (FAO) provides independent analysis on the state of the Province’s finances, trends in the provincial economy and related matters important to the Legislative Assembly of Ontario.

The FAO produces independent analysis on the initiative of the Financial Accountability Officer. Upon request from a member or committee of the Assembly, the Officer may also direct the FAO to undertake research to estimate the financial costs or financial benefits to the Province of any bill or proposal under the jurisdiction of the legislature.

This report was prepared in response to a request from a member of the Assembly. In keeping with the FAO’s mandate to provide the Legislative Assembly of Ontario with independent economic and financial analysis, this report makes no policy recommendations.

This report was prepared by Matthew Gurnham and Jacob Kim, under the direction of Luan Ngo and Jeffrey Novak.

External reviewers provided comments on early drafts of this report. The assistance of external reviewers implies no responsibility for this final report, which rests solely with the FAO.

Graphical Descriptions

| Fiscal Year | Renewable Cost Shift | OER | Rural Programs | Tax Credits | OESP | NIERP | Total |

|---|---|---|---|---|---|---|---|

| 2020-21 | 0.8 | 4.0 | 0.6 | 0.5 | 0.2 | 0.1 | 6.1 |

| 2021-22 | 3.1 | 2.4 | 0.6 | 0.5 | 0.2 | 0.1 | 6.9 |

| 2022-23 | 3.1 | 2.3 | 0.6 | 0.6 | 0.2 | 0.0 | 6.8 |

| 2023-24 | 3.1 | 2.2 | 0.7 | 0.6 | 0.2 | 0.0 | 6.7 |

| 2024-25 | 3.1 | 2.3 | 0.7 | 0.6 | 0.2 | 0.0 | 6.9 |

| 2025-26 | 3.0 | 2.1 | 0.8 | 0.6 | 0.1 | 0.0 | 6.6 |

| 2026-27 | 2.9 | 1.7 | 0.8 | 0.7 | 0.1 | 0.0 | 6.2 |

| 2027-28 | 2.8 | 1.9 | 0.8 | 0.7 | 0.1 | 0.0 | 6.4 |

| 2028-29 | 2.8 | 2.1 | 0.8 | 0.7 | 0.1 | 0.0 | 6.5 |

| 2029-30 | 2.7 | 2.3 | 0.8 | 0.7 | 0.1 | 0.0 | 6.7 |

| 2030-31 | 2.5 | 2.1 | 0.9 | 0.7 | 0.1 | 0.0 | 6.3 |

| 2031-32 | 2.3 | 2.2 | 0.9 | 0.7 | 0.1 | 0.0 | 6.2 |

| 2032-33 | 2.0 | 2.4 | 0.9 | 0.8 | 0.1 | 0.0 | 6.1 |

| 2033-34 | 1.7 | 2.4 | 0.9 | 0.8 | 0.1 | 0.0 | 5.9 |

| 2034-35 | 1.3 | 2.3 | 1.0 | 0.8 | 0.1 | 0.0 | 5.5 |

| 2035-36 | 0.7 | 2.4 | 1.0 | 0.8 | 0.1 | 0.0 | 5.0 |

| 2036-37 | 0.4 | 2.2 | 1.0 | 0.8 | 0.1 | 0.0 | 4.5 |

| 2037-38 | 0.2 | 2.2 | 1.1 | 0.8 | 0.1 | 0.0 | 4.4 |

| 2038-39 | 0.1 | 2.1 | 1.1 | 0.9 | 0.1 | 0.0 | 4.3 |

| 2039-40 | 0.1 | 2.0 | 1.1 | 0.9 | 0.1 | 0.0 | 4.2 |

| Year | Unsubsidized Residential Bill | Typical Residential Bill | Bill Reduction (per cent) |

|---|---|---|---|

| 2021 | 171 | 121 | 29% |

| 2022 | 166 | 120 | 28% |

| 2023 | 163 | 121 | 26% |

| 2024 | 165 | 122 | 26% |

| 2025 | 166 | 124 | 25% |

| 2026 | 161 | 126 | 22% |

| 2027 | 165 | 129 | 22% |

| 2028 | 166 | 130 | 21% |

| 2029 | 170 | 132 | 22% |

| 2030 | 167 | 134 | 20% |

| 2031 | 169 | 136 | 19% |

| 2032 | 172 | 139 | 19% |

| 2033 | 175 | 143 | 18% |

| 2034 | 176 | 148 | 16% |

| 2035 | 179 | 153 | 15% |

| 2036 | 179 | 157 | 12% |

| 2037 | 184 | 163 | 12% |

| 2038 | 188 | 168 | 11% |

| 2039 | 192 | 173 | 10% |

| 2040 | 194 | 178 | 9% |

| Year | Fair Hydro Plan | Ontario Electricity Rebate |

|---|---|---|

| 2018 | 116 | 116 |

| 2019 | 121 | 121 |

| 2020 | 120 | 121 |

| 2021 | 121 | 121 |

| 2022 | 124 | 120 |

| 2023 | 129 | 121 |

| 2024 | 136 | 122 |

| 2025 | 143 | 124 |

| 2026 | 151 | 126 |

| 2027 | 159 | 129 |

| 2028 | 167 | 130 |

| 2029 | 171 | 132 |

| 2030 | 169 | 134 |

| 2031 | 170 | 136 |

| 2032 | 172 | 139 |

| 2033 | 175 | 143 |

| 2034 | 176 | 148 |

| 2035 | 178 | 153 |

| 2036 | 179 | 157 |

| 2037 | 183 | 163 |

| 2038 | 186 | 168 |

| 2039 | 190 | 173 |

| 2040 | 193 | 178 |

| Customer Class | Electricity Subsidy | Share of Total (per cent) |

|---|---|---|

| Small Commercial | 24.3 | 61% |

| Large Commercial | 8.4 | 21% |

| Industrial | 7.2 | 18% |

| Fiscal Year | Large Commercial Bill Discount (per cent) | Industrial Bill Discount (per cent) |

|---|---|---|

| 2020-21 | 15.8% | 14.5% |

| 2021-22 | 15.7% | 14.4% |

| 2022-23 | 15.3% | 14.0% |

| 2023-24 | 14.9% | 13.6% |

| 2024-25 | 14.4% | 13.2% |

| 2025-26 | 13.8% | 12.7% |

| 2026-27 | 13.1% | 12.0% |

| 2027-28 | 12.3% | 11.3% |

| 2028-29 | 11.9% | 10.9% |

| 2029-30 | 11.4% | 10.4% |

| 2030-31 | 10.6% | 9.7% |

| 2031-32 | 9.5% | 8.7% |

| 2032-33 | 8.3% | 7.6% |

| 2033-34 | 7.0% | 6.4% |

| 2034-35 | 5.1% | 4.7% |

| 2035-36 | 2.8% | 2.5% |

| 2036-37 | 1.4% | 1.3% |

| 2037-38 | 0.8% | 0.7% |

| 2038-39 | 0.5% | 0.5% |

| 2039-40 | 0.2% | 0.2% |

Footnotes

[1] In constant 2022 dollars, the estimated 20-year cost of the nine programs is $103.6 billion.

[2] The Renewable Cost Shift is also referred to as the Comprehensive Electricity Plan.

[3] If the Province decides to extend the NIERP, then the total cost of the nine energy and electricity subsidy programs would increase by approximately $120 million for each year the NIERP is extended (assuming the program parameters remain the same).

[4] The FAO defines a “typical residential ratepayer” as a residential customer paying time-of-use electricity pricing with average monthly household electricity intensity. This ratepayer is not a rural or low-income ratepayer and so is ineligible for the OESP, DRP, RRRP and On-Reserve First Nations Delivery Credit. For information on the benefits these programs provide to rural and low-income Ontario households, see FAO, “Home Energy Spending in Ontario: Income and Regional Distribution,” 2021.

[5] “Ford Government Taking Bold Action to Fix Hydro Mess,” March 21, 2019.

[6] From $116 per month in 2018 to $121 per month in 2021.

[7] The difference in electricity bills under the two scenarios is due to the OER policy changes noted above: the Province’s current policy is to hold annual electricity bill increases for residential ratepayers to two per cent indefinitely (compared to the four years at the rate of inflation commitment under the FHP), and ratepayers will no longer have to repay any funds borrowed to reduce electricity bills through either the OER or the FHP.

[8] These are Class B ratepayers as defined by the Independent Electricity System Operator (IESO) that are not eligible for the OER.

[9] These are defined as Class A ratepayers by the IESO.

[10] Eligible ratepayers must consume a minimum of 50,000 megawatt hours of electricity per year.

[11] FAO, “Fair Hydro Plan: An Assessment of the Fiscal Impact of the Province’s Fair Hydro Plan,” 2017.

[12] “Ford Government Taking Bold Action to Fix Hydro Mess,” March 21, 2019.

[13] Also referred to as the Comprehensive Electricity Plan. See FAO, “The Cost of Subsidizing Green Energy Contracts for Industrial and Large Commercial Ratepayers,” 2021.

[14] For information on COVID-19-related energy and electricity subsidies up to September 2021, see FAO, “Federal and Provincial COVID-19 Response Measures: 2021 Update,” 2021. In addition, in January 2022, the Province introduced two new COVID-19-related energy and electricity subsidy programs. First, for 21 days, starting on January 18, 2022, the Province set electricity prices 24 hours a day at the current off-peak rate of 8.2 cents per kilowatt-hour for residential, small business and farm ratepayers. Second, the Province opened applications for the Ontario Business Costs Rebate Program, which provides eligible businesses that are required to close or reduce capacity with rebate payments for up to 100 per cent of the property tax and energy costs they incur while subject to public health measures in response to the Omicron variant.

[15] Also referred to as the Comprehensive Electricity Plan.

[16] For more information on the Renewable Cost Shift, see FAO, “The Cost of Subsidizing Green Energy Contracts for Industrial and Large Commercial Ratepayers,” 2021.

[17] The OER currently provides an on-bill rebate equal to 17 per cent of pre-tax electricity bills; however, the FAO estimates that the average rebate in 2021 was equal to 19 per cent of the pre-tax electricity bill.

[18] The OEPTC benefit unit consists of a single adult or a couple, and any dependant children under the age of 18.

[19] Eligible ratepayers must consume a minimum of 50,000 megawatt hours of electricity per year.

[20] The NOEC benefit unit consists of a single adult or couple, and any dependant children under the age of 18.

[21] In constant 2022 dollars, the estimated 20-year cost of the nine programs is $103.6 billion.

[22] This is partially offset by reductions in subsidies under the Renewable Cost Shift. When the Renewable Cost Shift was introduced in January 2021, the OER rebate was lowered to offset the subsidy that the Renewable Cost Shift provides to OER-eligible customers. This explains the drop in OER spending from $4.0 billion in 2020-21 to $2.4 billion in 2021-22. Therefore, as the Renewable Cost Shift expires, OER spending will need to be re-adjusted to account for electricity price increases that result from the expiring subsidy under the Renewable Cost Shift.

[23] In addition, the FAO’s forecast assumes no change in the program take-up rate between 2020-21 and 2039-40. The FAO estimates that approximately 30 per cent of eligible households received the OESP in 2020-21.

[24] In constant 2022 dollars, the estimated 20-year cost of the two program changes is $45.1 billion.

[25] The incremental cost estimate of $52.9 billion only reflects the impact of the two program changes after accounting for changes to the electricity market that have occurred since 2017.

[26] The Province continues to pay for the cost of funding the RRRP and OESP.

[27] Although previous announcements by the Province indicated that under the OER annual electricity bill increases would be held to the rate of inflation (“More Transparent Electricity Bills Coming to Ontario Households,” October 22, 2019), staff from the Ministry of Energy reported to the FAO that the current policy is to hold electricity bill increases to two per cent. For perspective, from 2020 to 2040, the FAO projects that the rate of inflation will average 2.1 per cent in Ontario.

[28] For more information on the Renewable Cost Shift, see FAO, “The Cost of Subsidizing Green Energy Contracts for Industrial and Large Commercial Ratepayers,” 2021.

[29] The FAO defines a “typical residential ratepayer” as a residential customer paying time-of-use electricity pricing with average monthly household electricity intensity. This ratepayer is not a rural or low-income ratepayer and so is ineligible for the OESP, DRP, RRRP and On-Reserve First Nations Delivery Credit. For information on the benefits these programs provide to rural and low-income Ontario households, see FAO, “Home Energy Spending in Ontario: Income and Regional Distribution,” 2021.

[30] Of note is that while the overall average annual electricity bill growth for a typical residential ratepayer is projected to be two per cent, electricity bill increases in each year will vary due to projected changes in household electricity intensity. The FAO projects electricity bill increases will be less than two per cent annually through 2032 as average electricity use per household is projected to decline over that period. However, from 2032 through 2040, the FAO projects increasing household electricity use, which will result in electricity bill growth that is higher than two per cent annually.

[31] The IESO projects that the unit cost of electricity in Ontario will grow at an annual average rate of 0.6 per cent from 2021 to 2040.

[32] “Ford Government Taking Bold Action to Fix Hydro Mess,” March 21, 2019.

[33] Some of the difference between the Province’s estimate (2023) for when typical residential electricity bills will be 12 per cent lower under the current electricity subsidy programs compared to the electricity subsidy programs from 2017 versus the FAO’s estimate (2025) can be explained by the Ministry of Energy and the FAO using different assumptions. For example, the FAO’s estimate utilizes average residential intensity, which changes over time, whereas the ministry’s assumption is based on a proxy residential customer that consumes a fixed 700 kWh per month. Additionally, the FAO’s forecast incorporates the Province’s latest demand projections, which were published after the Ministry of Energy and the IESO responded to the FAO’s information request for this report.

[34] See https://www.ontario.ca/page/changes-your-electricity-bill for more information on eligibility for the OER. In addition, other electricity customers that are currently receiving the OER under the grandfathering regulatory provisions will continue to receive the rebate until October 31, 2022.

[35] Eligible ratepayers must consume a minimum of 50,000 megawatt hours of electricity per year.

[36] FAO, “The Cost of Subsidizing Green Energy Contracts for Industrial and Large Commercial Ratepayers,” 2021.

[37] The demand projections that the FAO used in this report are from the IESO’s 2021 Annual Planning Outlook which can be found here: https://www.ieso.ca/en/Sector-Participants/Planning-and-Forecasting/Annual-Planning-Outlook.

[38] More information on the Global Adjustment Modifier calculation can be found here: https://www.oeb.ca/sites/default/files/RPP-GA-Modifier-Report-20190417.pdf.

[39] The 2020 Electricity Distributor Yearbook can be found here: https://www.oeb.ca/utility-performance-and-monitoring/natural-gas-and-electricity-utility-yearbooks.